Government-backed lender Royal Bank of Scotland (RBS) has warned that it was ‘very unlikely’ to meet its 2020 financial targets.

While the bank maintained its 2019 outlook it admits that it is very unlikely that it will hit its tangible equity returns target of more than 12% or get below 50% cost-to-income ratio in 2020.

‘Given market conditions, continued economic and political uncertainty and the contraction of the yield curve, it is very unlikely,' said RBS today.

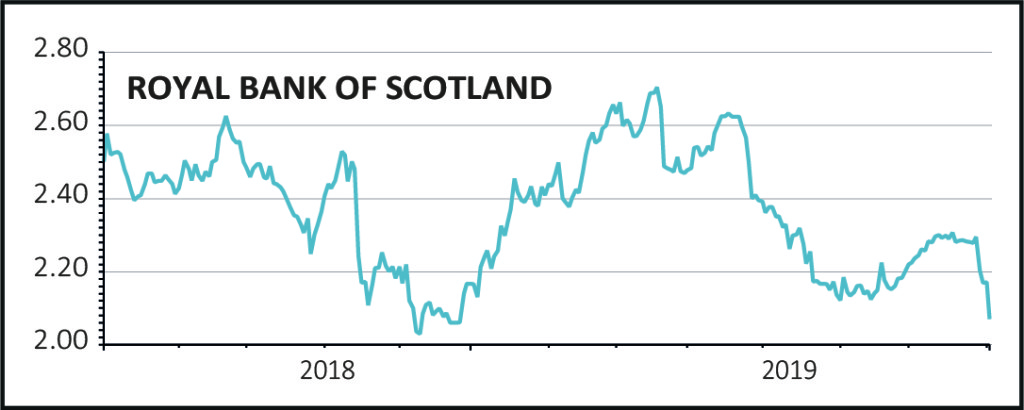

That saw the share price slump nearly 6% to 204p, offsetting forecast-beating first half pre-tax profits and a promised £1.7bn special dividend.

FORECAST-THUMPING PROFITS

Pre-tax profits of £2.7bn were above analysts’ forecasts of £2.3bn and last year’s £1.8bn largely thanks to a £990m boost from selling a stake in Saudi Arabian bank Alawaal.

RBS will pay an interim dividend of 2p per share and a special dividend of 12p per share on 20 September. Shareholders on the register as of 16 August will be eligible for both payments.

READ MORE ABOUT RBS HERE

RBS reported a first half return on tangible equity of 12.1% but taking out the gain on the Alawaal sale the return was just 7.5%.

The Personal Banking division managed to increase mortgage lending by £14.3bn yet lower margins on new mortgages meant that the net interest margin (the difference between what the bank charges on loans and what it pays on deposits) in personal banking dropped by 17 basis points or 0.17% to 2.51% at the end of June.

BAD LOANS ESCALATING

Also of concern is the fact that ‘impairments’, or money put aside for bad loans, is starting to expand quickly, albeit from a low level.

Charges were £181m in the first half compared with £131m a year ago, and the second quarter saw quite a step up from the first quarter ((£112m against £63m).

These numbers are still small in terms of the size of RBS’s total loan book but they suggest that the low point in the cycle for provisioning for bad loans is behind us and the news flow is likely to get gloomier not rosier.

The Commercial Banking division continues to amass savings as companies stock-pile their cash but loan growth was marginal as large firms are increasingly delaying refinancing in the run-up to Brexit.

After a poor first quarter the NatWest Markets division had a tough second quarter, with income in the core business down by £52m ‘reflecting the impact of difficult market conditions’. The only saving grace was that costs were down.