The outlook for the airline sector looks grimmer after Ryanair (RYA) warned of fare price cuts and potential operational disruption from the Brexit vote.

The low-cost airline has stuck to previous guidance that this will likely lead to an average fares cut of 8% in the six months to 31 March 2018. This is because of biting pricing competition.

Despite the expected decline in fare prices, analysts have not downgraded forecasts for the year to March 2018.

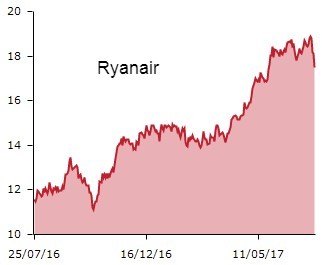

Shares in Ryanair slumped 3.2% on Monday to €17.52, valuing the airline at a little more than €19bn. Direct competitor EasyJet (EZJ) is also lower, as is British Airways-owner International Consolidated Airlines (IAG), the pair down 2.8% and 5.7% in sympathy.

BREXIT DOMINATES

Perhaps more worrying is bleak talk of Ryanair flights disruption between the UK and Europe if Britain fails to remain part of the EU Open Skies agreement. It allows freedom of travel between the UK and EU member states.

Brexit discussions could see the UK strike a new, independent agreement, but investors clearly perceive this as another block in the growing wall of uncertainty around Brexit negotiations.

Despite these headwinds, a late Easter and a 1% rise in average fares have helped the airline boost pre-tax profit by 55% to €397m in the three months to 30 June 2017.

Ryanair has also increased its full year traffic target from 130 million to 131 million, although lower fares may offset the positive impact.

FARES NOT ONLY FACTOR

Shares explained at length last week why investors should not solely focus on ticket sales when analysing Ryanair's shares and investment potential. Mark Irvine-Fortescue, analyst at Panmure Gordon, seems to agree.

He remains largely upbeat, highlighting ancillary revenue performance targeted at 30% of sales by 2020, a factor that chimes with Shares' and the analysis of other brokers. Irvine- Fortescue also flags growth opportunities through restructuring.

The analyst forecasts that sales at Ryanair will rise to €7,026m in the year to March 2018, up from €6,647.8m.

Cantor Fitzgerald analyst Robin Byde is more cautious, however. He highlights that ‘demand for air travel, Brexit, yield costs and external events’ are potential risks to the company.