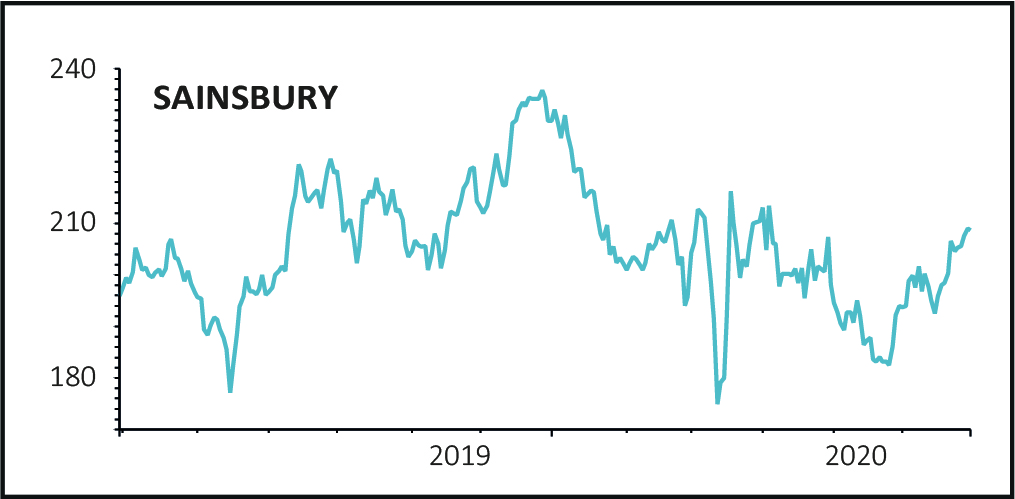

Shares in supermarket group Sainsbury’s (SBRY) gave up their early gains to trade sideways at 208p as investors bemoaned the fact that, despite a record increase in sales last quarter, the firm left its full year earnings outlook unchanged.

For the 16 weeks to 27 June, grocery sales rose 10.5% and general merchandise sales rose 7.2% boosted by a 10.7% increase at Argos.

However, a rise in costs of more than £500m to cover in-store hygiene and distancing measures and investment in its online business meant that the benefit of stronger grocery sales and business rate relief were largely negated.

New chief executive Simon Roberts said it was ‘appropriate to remain cautious about the sales trajectory through the remainder of the year’ and reiterated the board’s base case scenario of ‘broadly unchanged’ underlying pre-tax profits for the full year.

STRONG TRADING

On a like for like basis, excluding fuel sales which fell more than 50% due to the restrictions on driving during lockdown, total retail sales grew by a record 8.5% in the first quarter of the current financial year.

Sales growth of 10.5% in groceries was ahead of the market as measured by Kantar with online sales up 87% on last year and more than 650,000 orders a week, an increase of 75% since the start of the pandemic.

The ‘click and collect’ service proved especially popular during lockdown with sales increasing by a whopping 13 times over last year’s first quarter.

Despite all of its 573 Argos stores being shut from late March in line with official guidance, home delivery sales grew by 78% and ‘click and collect’ by 53% which is a testament to its online offering.

Also, while clothing sales were down over 25% during the quarter, categories such as loungewear, exercise wear and children’s wear performed well and thanks to successful clearance sales the stock position at the end of June was better than anticipated.

INCREASED COSTS

Set against the record increase in sales was a major increase in spending on digital and delivery services to cope with the sudden increase in demand, as well as spending on hygiene and safety measures in stores.

Staff costs also soared as the company hired more than 25,000 employees across its stores and distribution centres and to handle the increased number of home deliveries.

Although the firm doesn’t expect the current strong sales growth to continue indefinitely, it’s fair to assume that some if not all of the ‘channel shift’ to online will stick as consumers appreciate the flexibility of being able to get their shopping delivered.

Also, surveys suggest that where customers have switched their primary or secondary choice of shop during the pandemic, they show a strong tendency to stick with their decision.

Therefore, although costs have risen materially, it may be that they have simply been brought forward as the crisis has accelerated the trend towards more people shopping online for their groceries.