The cost of producing shale oil should provide a floor for the US benchmark West Texas Intermediate (WTI) of around $80 a barrel. This is according to exchange-traded product provider ETF Securities which has today published a detailed report on shale oil, a key new source of supply in the world energy market. WTI currently trades at $95 a barrel.

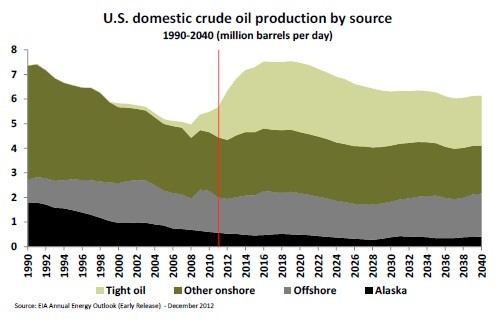

The report, produced by research director Edith Southammakosane, highlights the International Energy Agency's (IEA) forecast that the US will overtake Saudi Arabia and Russia to became the largest global oil producer by 2020. Much of this increase can be attributed to shale oil which, as the research explains, is oil contained in tight formations which can be produced using hydraulic fracturing and horizontal drilling.

The increased supply from shale oil comes at a time of declining US demand. To keep shale oil economically viable, Southammakosane says the authorities will have to consider increasing either the number of permits to export oil or the number of refineries capable of processing the increased supply.

She goes on to note 'the shale oil boom is starting to expand outside of the US', highlighting activity in China and Russia.

Yesterday it was reported that Imperial Energy, which used to be listed on the London Stock Exchange before being taken over by Indian state oil firm ONGC in 2009, is looking to boost production from its Siberian fields by exploiting the shale oil potential in the Bazhenov formation.

Bazhenov is thought to be the biggest shale oil play in the world, with some estimates putting the potential at as much as one trillion barrels of oil, and Imperial is looking for a partner with the necessary expertise and financial clout to assist in assessing its portion of this bounty.