Investors haven’t been bowled over by Royal Dutch Shell’s (RDSB) strategy update where it says oil production has now peaked and that it will accelerate efforts to drive down carbon emissions.

Its shares fell 1.8% to £12.82, despite Brent crude oil prices hold firm above $61 per barrel. Shell’s share price is normally highly leveraged to the oil price.

The FTSE 100 company says it will look to grow its dividend by around 4% a year and reduce net debt to $65 billion.

What appears to have gone down poorly with the market is Shell’s guidance for spending. In particular, the company doesn’t seem to be in a rush to bulk up its position in renewable energy.

SPENDING PLANS

Shell plans to rebalance its portfolio of assets, guiding for the following annual investment:

$8 billion in ‘upstream’ which is looking for oil and gas, drilling and operating wells

$4 billion to $5 billion in chemicals and associated products

$4 billion in integrated gas

$3 billion in marketing

$2 billion to $3 billion in renewables and energy solutions

‘Some people will be surprised that it isn’t being more aggressive with its move towards renewable energy,’ says Russ Mould, investment director at AJ Bell. ‘The company says it will invest roughly twice as much in gas and chemicals and up to four times as much in drilling for oil and gas than in renewables.’

‘Shell may argue that it is a juggernaut that can’t be turned around quickly and that its latest plans provide a clear strategy for achieving net zero emissions by 2050. Nonetheless, that’s nearly 30 years away and we’re living in a world that demands businesses be environmentally friendly today, not long in the future.

FALLING OUT OF FAVOUR WITH INVESTORS

Shell has historically been popular with income investors thanks to a generous dividend yield. It was a favourite among fund managers who felt its gigantic oil and gas assets would provide a resilient stream of income.

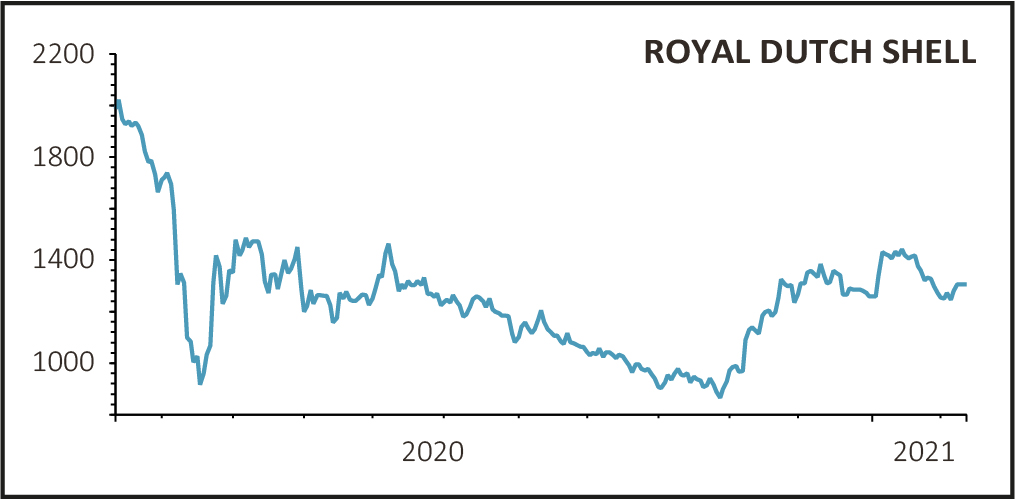

Sentiment has changed in the last few years as the world pays more attention to ESG (environmental, social and governance) issues. Shell has seen its share price come under pressure, oil prices have dipped, and the company was forced to cut its dividend, thus losing a lot of investor fans.

The plans to start growing the dividend again is a welcome development and the share price briefly picked up earlier this year thanks to oil prices regaining strength. But will this be enough to improve how investors view the company longer term?

‘Its latest strategy update could lose even more supporters in the investment community as there are so many other companies offering a more ESG-friendly proposition,’ remarks Mould. ‘Green companies are attracting strong interest from investors and Shell may continue to score badly on ESG screens despite its strategy shift.

‘However, against this backdrop there is also a growing belief from some analysts that we’re at the start of a new supercycle for commodities, particularly oil which has been in the doldrums in recent years.’

‘Therefore, Shell could still appeal to investors who care more about dollars than a company doing the right thing for society. Its ability to generate strong amounts of cash may be enough to gain their support, particularly if its shares are unloved and are going cheap.’