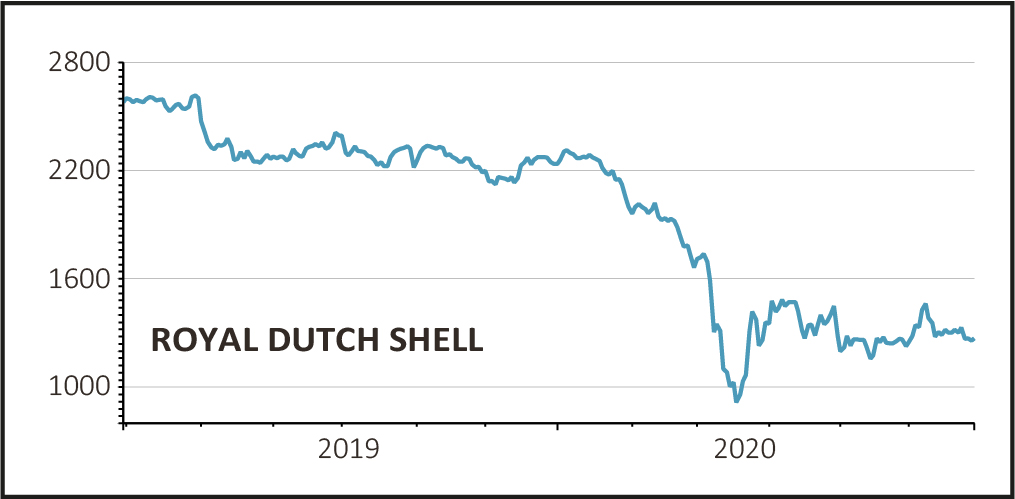

Shares in Royal Dutch Shell (RDSB) fell 2% to £12.46 as it revealed up to $22 billion worth of write downs to the value of its assets.

These reflect the impact of falling commodity prices as demand for oil and gas has fallen in the wake of the coronavirus pandemic.

Shell’s announcement follows in the footsteps of British rival BP (BP.), which announced giant impairment charges earlier this month.

Shell said it now expected Brent crude prices to average $35 a barrel in 2020, rising to $40 in 2021, $50 in 2022 and $60 in 2023.

It pegged its long-term forecast at $60 per barrel.

The company also cut its Henry Hub gas price forecasts and slashed its average long-term refining margin expectation by around 30%.

The impairments are expected to have a pre-tax impact in the range of $20 billion to $27 billion.

Company gearing was expected to rise up to 3% due to the impairments, while additional impacts on gearing levels were expected due to pensions revaluations.

PRODUCTION EXPECTATIONS UPDATED

Shell also updated its production expectations for the second quarter, including a forecast for upstream oil and gas production of between 2.3 billion and 2.4 billion barrels of oil equivalent per day.

‘Although this production range is higher compared with the outlook previously provided, it has had a limited impact on earnings in the current macro environment,’ Shell said.

AJ Bell investment director Russ Mould commented: ‘For Shell the coronavirus has not just been a short-term headache. It is proving to be a long-lasting migraine and the level of pain being experienced by the business is evident in today’s teaser for its second quarter results.

‘The scale of the write-downs to the value of its assets are eye-catching and reflect the significant drop in energy prices linked to the pandemic, though of perhaps more concern is the ongoing impact on its integrated natural gas business.’

Mould added: ‘A big part of Shell’s strategy in the 2010s was built around increasing its exposure to gas and it was the key driver behind the mega-merger with BG in 2016.

‘This has given it substantial exposure to the liquefied natural gas (LNG) market and the typical three to six month lag in LNG prices responding to the oil price means the company is only just beginning to feel the pain here.’