Investing in smaller companies can be higher risk than putting money to work in well-established blue chip businesses. Yet with additional risk comes the potential for bigger rewards, as there are few better investments than businesses that can grow over the long-term.

Spotting the right smaller companies is the difficult bit. One way to mitigate single stock risk is to put your money to work with a professionally-managed, dedicated smaller companies fund steered by a manager with a strong track record. One such name is the TB Amati UK Smaller Companies Fund (GB00B2NG4R39), managed with distinction since 2000 by one-time professional violinist Dr Paul Jourdan, and co-managed with his Amati Global Investors colleagues Douglas Lawson and David Stevenson since 2009 and 2012 respectively.

The £20 million open-ended investment company (OEIC), eligible for ISAs, aims to generate medium to long term capital growth by investing in a diversified book of UK small caps, with 80% of the portfolio invested in the bottom 10% of the UK listed companies. Award-winning small cap investor Jourdan is keen to champion the attractions of investing in growth companies quoted on AIM, concedes that 'certain areas of the market have been torn apart by bad accounting practices or fraud.

But his view is that 'UK smaller companies is a really outstanding asset class as a whole, providing that you can avoid the bombshells. It is all about finding companies that can grow at a good healthy rate with a good level of conviction.'

On the topics of cash flow and assessing business quality, Jourdan explains: 'Forming a view about the quality of a business is a multi-faceted task. Some aspects of it can take a long time, particularly when weighing up a management team. But the accounts are the best place to start. Like many investors we attach great importance to the cash flow statement. We take our own view about what 'adjusted earnings' should be. We have seen some extreme cases where stated 'adjusted earnings' amount to little more than 'earnings before costs'!

To give a simple example:

we will almost always deduct capitalised R&D in the cash flow as a business expense in the P&L, and add back amortisation of previously capitalised R&D in our view of adjusted earnings.'

As an active manager, Jourdan's role is as much about managing the additional risks inherent in the asset class as it is about choosing the best performing companies. He therefore aims to maintain an attractive long term investment portfolio based around businesses which have the ability to grow consistently, with below average volatility and adequate liquidity with respect to the size of the fund. Amati also manages two AIM-based Venture Capital Trusts (VCTs) - Amati VCT and Amati VCT 2 - which gives its managers a very early view of the emerging growth companies coming to market.

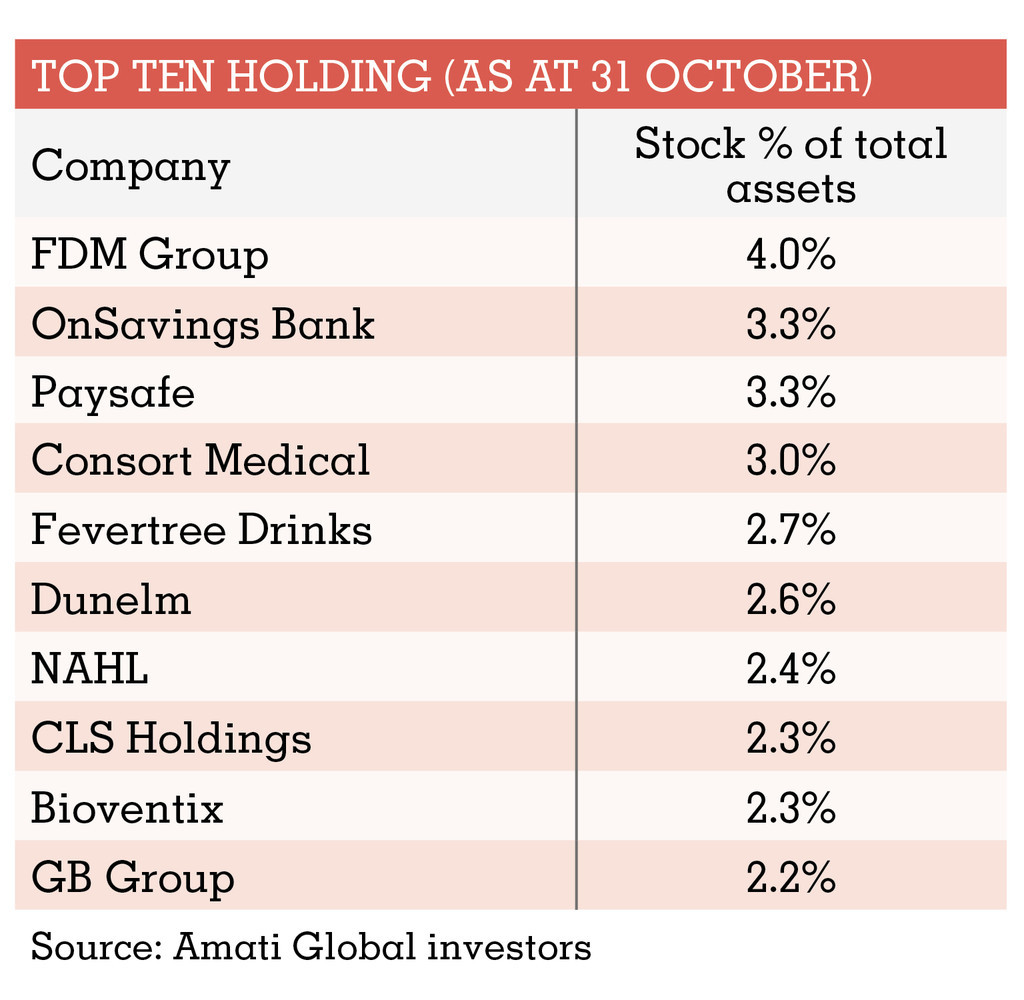

Examination of the latest factsheet for the Amati UK Smaller Companies fund reveals a top 10 that includes larger corporate names such as cash-generative homewares retailer Dunelm (DNLM), Consort Medical (CSRT) and niche lender OneSavings Bank (OSB).

Lower down the market cap spectrum, the list includes Bioventix (BVXP:AIM), a biotech minnow specialising in the development of sheep monoclonal antibodies that are used in clinical diagnostic and drug abuse testing. Bioventix's full-year results (5 Oct) beat market expectations.

One of the manager's current portfolio favourites is FDM (FDM), a global IT services provider and 'a business we really like'. Another recent addition to the small cap fund is Keywords Studios (KWS:AIM), 'a provider of localisation, cultural adaption and testing services to the global video games industry', bought ahead of strong interim results.

'Gaming is the largest entertainment industry in the world,' explains Jourdan, pointing out that 'recent acquisitions on the creative side of the industry and special projects such as development work on Facebook?s Oculus Rift virtual reality system have reduced the company?s reliance on its core localisation business, which itself is just beginning to recover from the disruption to the development cycle caused by the so-called 'console wars' between Sony, Microsoft and Nintendo.

We think Keywords is a very well run business and it is a consolidator in its sector and it is a stock that is priced for its quality.'

Also boosting the performance of the portfolio is Fevertree Drinks (FEVR:AIM), the premium tonic-to-ginger beer supplier with tasty global growth potential. 'We continue to really like it as a business,' says Jourdan. 'The international roll-out of that product should continue very rapidly.'

When quizzed on the soft drinks firm's high equity valuation, Jourdan concedes 'it looks like a full rating, but you are taking a view on whether that growth rate can continue'.

The manager is also enthusiastic about Pantheon Resources (PANR:AIM), which 'has been the only real bright spot in the E&P sector this year, rising spectacularly after it produced a hugely positive well result from its first well onshore in East Texas. Behind the scenes this discovery was no accident, and is the result of many years of research, much of which was conducted by the Bureau of Economic Geology at the University of Texas.

This work theorised a new set of conditions for drilling successful wells in the prolific Eagle Ford Formation which lies deep under this ground.

The key point to grasp about Pantheon is that if this theory proves to be correct, it could exploit up to five new basins in its existing acreage, each containing more than 50 million barrels of oil equivalent of conventional oil and gas production.

Because this is conventional production lying very close to existing infrastructure the costs of developing these fields should be very low, and the developments would be commercial even below the current oil and gas prices. The second well result from a different basin to the first is expected shortly.'

QUICK FUND FACTS (OCTOBER 2015)

Launch date: December 1998

Fund size: £20 million

IMA Sector: UK Smaller Companies

Benchmark: Numis Smaller Companies Index (plus AIM, ex Investment Co's)

No. of holdings: 62

Share type: Accumulation

ISIN: GB00B2NG4R39