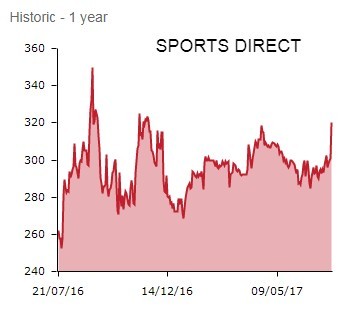

Unloved sporting goods giant Sports Direct International (SPD) is in investors’ good books for the first time in recent memory. That's despite annual numbers revealing a massive slump in profits.

Mike Ashley’s optimistic outlook statement, including the news trading in new generation flagship stores is ‘exceeding our expectations’, combines with the appointment of a new finance director to spark a 6.8% share price rally to 321.15p.

OUT OF PUFF?

The cut-price trainers, tennis rackets and running gear retailer has been in the doghouse with media commentators and investors alike for some time now. Controversies over corporate governance and working practices at its sprawling Shirebrook warehouse and a string of disappointing updates and earnings downgrades currently weigh on the share price.

Results for the year to 30 April make grim reading, underlying profit before tax slumping the best part of 60% to £113.7m. Margins were crimped by the devaluation of sterling versus the dollar and earnings were also dented by depreciation charges, a tougher UK high street backdrop and ‘strategic challenges in our operations in continental Europe’.

RELIEF RALLY

However, this sharp earnings decline was already baked into the share price. This explains why the grounds for optimism in today’s commentary from Ashley, Sports Direct’s unconventional majority shareholder who took over as CEO following Dave Forsey’s departure last year, are triggering a rebound.

‘We have invested over £300m in property over the last year, and I am pleased to report that early indications show that trading in our new flagship stores is exceeding expectations.'

Ashley provides two examples of new generation flagship stores, both of which are delivering far greater earnings before interest, taxation, depreciation and amortisation (EBITDA) than an average Sports Direct store.

OPTIMISTIC OUTLOOK

‘Our outlook is optimistic and we aim to achieve growth in underlying EBITDA in the region of approx. 5%-15% during full year 2018,’ says Ashley. ‘However, we will continue to be conservative in managing for the medium to long term, which may result in short-term fluctuations in underlying EBITDA, particularly given the continued uncertainty surrounding Brexit.’

At pains to point out it has created 4,800 new UK jobs since going public a decade ago, Sports Direct is opening more new generation and flagship-style stores to enhance its offering to customers and improve its ties with third party brands.

Today, it announces a new strategic partnership with ASICS ‘in response to the ever changing demands of the running consumer in today's Sporting Goods marketplace’.

This marks an important step in Sports Direct's journey to being recognised as the 'Selfridges of Sport' and aims to build upon the retail brand's most recent positioning as 'The Home of Football'.

In addition to Ashley’s positive EBITDA growth outlook, the market is also relieved as Sports Direct finally appoints an experience numbers man, acting CFO Matt Pearson having exited the business last year.

Former Wincanton (WIN) bean counter Jon Kempster, a man with a wealth of public company experience, comes on board as chief financial officer on 11 September.