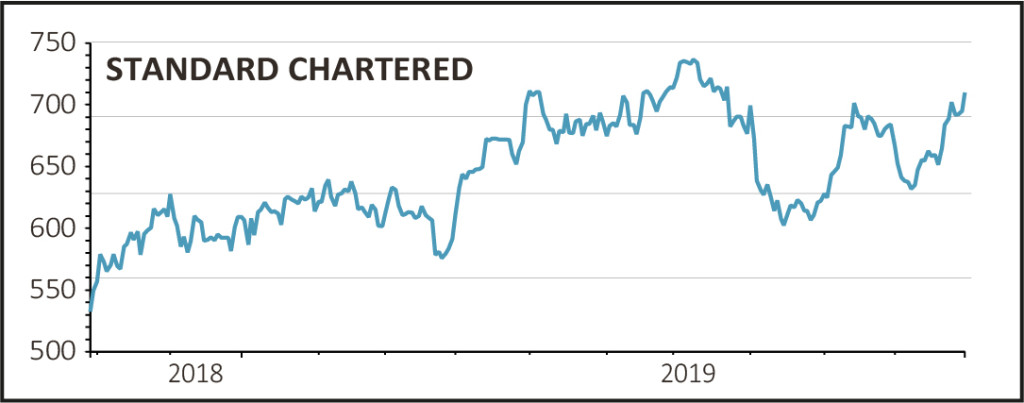

Shares in emerging market-focused bank Standard Chartered (STAN) rallied 3.5% to a four-month high of 719.2p after it delivered a stronger than expected third quarter trading update.

Given the disturbances in Hong Kong, the bank’s biggest market, third quarter trading was resilient with underlying pre-tax profits growing 16% to $1.24bn, well ahead of analysts’ expectations which were for earnings to remain flat on the previous year.

Performance was particularly strong in the core Corporate and Institutional Banking unit, where operating income rose by 13% to $1.87bn, and the much smaller Private Banking unit where income rose by 14% to $145m. Retail Banking income grew by a steady 4% to $1.32bn while Commercial Banking income picked up, registering 8% growth to $372m.

By region, Asian markets grew their income by 13% while Europe and the Americas grew income by 19%.

Meanwhile operating costs were virtually flat on the previous year at $2.5bn so more of the income dropped to the bottom line, helping the bank to beat forecasts.

While operating costs will be slightly higher in the fourth quarter than the third quarter due to the timing of investments, for the full year they are still only expected to rise by less than the rate of inflation (currently 1.7% according to the Office for national Statistics).

MEASURED RESPONSE

One reason for the shares not jumping more on the results is that a big part of the increase in the Corporate and Institutional Banking result came from the financial markets division, where income grew by 25%.

Credit and capital markets income more than trebled due to smart trading, but obviously these kind of gains aren’t guaranteed to be repeated on a regular basis so the market typically treats them with caution.

Another reason for the shares not racing ahead is that charges for expected credit losses rose to the equivalent of 0.42% of total loans in September, up from 0.26% in June and just 0.12% in March.

The bank blamed the increase on higher provisions for ‘a small number of unconnected corporate exposures’ as well as ‘continuing geopolitical uncertainty’. In its outlook statement it also referred to ‘expectations of declining near-term global growth’ which would clearly take a toll on global banks.

Emerging-market rival HSBC (HSBA) reported a sharp increase in bad loan provisions when it released its third quarter results earlier in the week. Provisions for losses in its Commercial Banking unit ballooned by 200% to $900m over the nine months to the end of September.