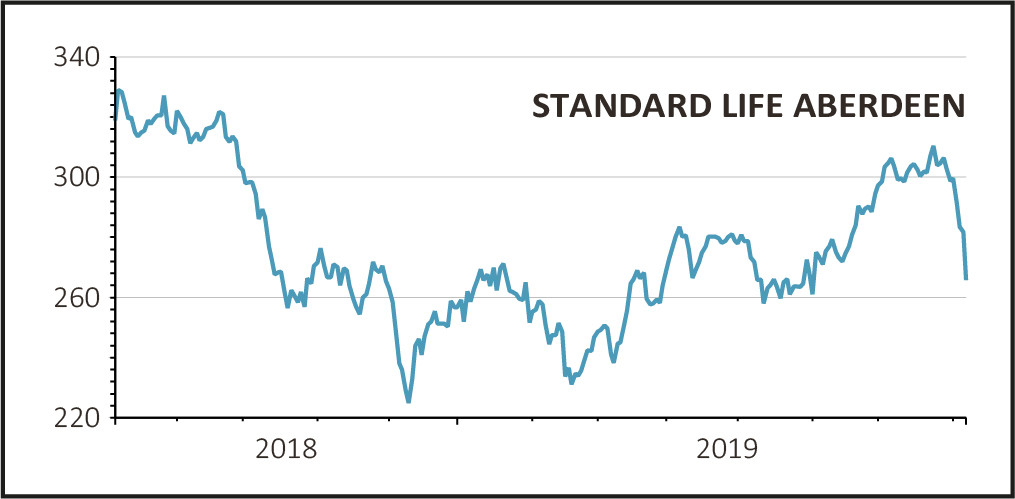

Shares in the UK’s largest listed wealth manager Standard Life Aberdeen (SLA) dip 5.5% to 266p despite the firm posting an increase in first half assets under management (AUM) and headline earnings.

Instead investors seem to be focusing on continued outflows from its Absolute Return funds and adjusted pre-tax profits which came in just shy of market estimates.

Total assets under management and administration (AUMA) rose 5% in the first half to £577.5bn thanks to an improvement in investment performance and a raft of agreements with firms such as Skipton Building Society and Virgin Money.

Net outflows were reduced to £15.9bn from £24bn a year ago and were concentrated in a couple of strategies with equities experiencing low demand ‘across the wider market’.

READ MORE ABOUT STANDARD LIFE ABERDEEN HERE

Net profits for the first six months increased to £636m against £111m the previous year due to a large gain on the sale of a stake in Indian insurer HDFC Life.

However adjusted pre-tax profits came in at £280m against market forecasts of £288m as management fees were lower due to the outflow of money from equity products, which typically earn higher margins.

Looking beyond the numbers it has been a year of progress for Standard Life Aberdeen, which was formed as a result of a merger in 2017.

Performance has been strong with 65% of assets directly managed beating their benchmark over three years, up from 50% at the end of 2018.

The UK advice business has continued to grow with the acquisitions of the wealth advisory businesses of BDO Northern Ireland and Grant Thornton UK taking assets under advice to £6bn.

The company also retained £35bn of assets owned by Lloyds (LLOY) after the bank terminated its management agreement unlawfully, with a mandate to manage the assets until at least April 2022.

It will receive an upfront payment from Lloyds of £140m to compensate for the loss of other assets, which will be booked as profit in the second half.