Shares in specialist recruiter SThree (STHR) have risen by 4% to 284p after full year results hit the firm’s recently raised guidance.

Total revenue was up 13% last year to £1.26bn with gross profit up 12% to £321m and pre-tax profit up 20% to £53.4m.

Like its larger rivals, the company’s biggest markets are outside the UK which makes it more resilient to political and economic turbulence than more domestic support service stocks.

Global supply-demand imbalance driving growth

SThree specialises in providing staff with science, technology, engineering and mathematics skills.

Over 70% of revenue and profit comes from supplying contract staff and demand is strong in its core areas of engineering, finance, IT and life sciences.

It has also seen an upturn in demand from the energy sector which helped boost gross profit last year.

As rivals Hays (HAS), PageGroup (PAGE) and Robert Walters (RWA) have previously reported, there is a major shortage of skilled staff and the global imbalance between supply and demand is unlikely to change in the near future.

Thanks to its geographic reach over 80% of gross profit comes from outside the UK and Ireland with the bulk coming from Europe and the US.

European gross profit was up 20% during the year driven by Germany, Austria and Switzerland where contract workers with technology skills are in high demand.

Other stand-out markets were Belgium, Netherlands and Spain.

Gross profit from the US was up 8% with particularly strong demand from the energy sector, including renewables.

Analysts upgrading forecasts

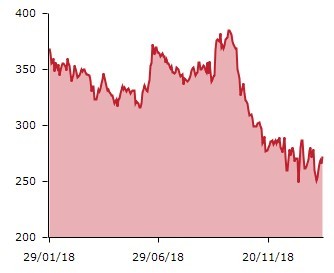

In mid-December the firm upgraded its expectations for gross profit, lifting the shares from what was at that point a two-year low of 260p.

Following the latest results a couple of brokers have raised their earnings forecasts and one has raised its price target.

Analysts at UBS have raised their 2019 earnings per share forecast by 1% and reiterated their price target of 420p.

Meanwhile Liberum have raised their earnings per share forecast by 3% and increased their price target from 450p to 475p.