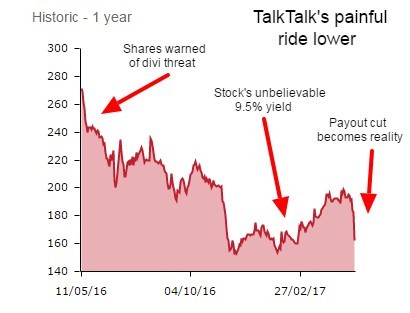

Full year results from embattled UK broadband and telecoms supplier TalkTalk (TALK) are weaker than expected. The dividend is being slashed by 50% and the share price is down 10%, trading at 164p in early dealing on 10 May 2017.

To put the stock performance into perspective, the share price was above 400p less than two years ago, and is down 34% since Shares first warned of a likely payout cut back in June 2016.

‘TalkTalk’s 8%-plus dividend yield at yesterday’s close looked like it was in “too good to be true” territory, especially as earnings cover for the pay-out was less than one-times,’ explains Russ Mould, investment director at broker AJ Bell. ‘But, the cut in the 2018 dividend to 7.5p (from 10.29p in the year just ended) is deeper than expected and that explains why the shares are receiving such harsh treatment this morning.’

NEW STRATEGY

The company has also laid out a new strategy that will put growth at the top of its to do list. TalkTalk has stated that the focus for the company is ‘growth, cash generation and profit in that order.’

Executive chairman Charles Dunstone ‘is now recognising that the company cannot deliver both growth and profitability,’ explains Philip Carse, analyst at research boutique Megabuyte.

Dunstone returned to a hands-on role at the company in the wake of former CEO Dido Harding’s resignation in February. There’s also a new CEO in the shape of Tristia Harrison, the former managing director of the company’s Consumer business.

‘TalkTalk has cleared the deck and dramatically rebased expectations,’ says analyst at investment bank Macquarie. They accept that the fallout is ‘unhelpful in the short term,’ but should allow for targets ‘more deliverable and constructive in the midterm.’

The analysts remain hopeful that today’s dramatic rethink by new management will allow ‘for a new direction and different level of expectations.’

TRIPLE-PLAY PRICE WARS

But competition in the UK space remains vicious, with ‘rival retail broadband providers, including BT/EE (BT.A), Sky (SKY), Vodafone (VOD) and Virgin Media all fighting for triple-play customers,’ explains Martin Courtney of the TechMarketView website.

Triple-play refers to the broadband, calls and TV services all delivered by a single supplier.

According to the analyst, key up/downside risks include UK market competition, cash usage, potential mergers and acquisitions and cost-cutting execution.

FORECASTS SLASHED

Number crunchers at Barclays Equity Research have slashed full year to 31 March 2018 forecasts, 19% being lopped off earnings before interest, tax, depreciation and amortisation (EBITDA) estimates while earnings per share (EPS) is cut by 30%, to £286m and 9.7p respectively.

That implies a forward price to earnings (PE) multiple of 16.9. The reset 7.5p per share dividend this year puts the yield at 4.6%.

It may be just a ‘matter of time before analysts start to ponder whether TalkTalk is a potential bid candidate,’ concludes AJ Bell’s Mould.