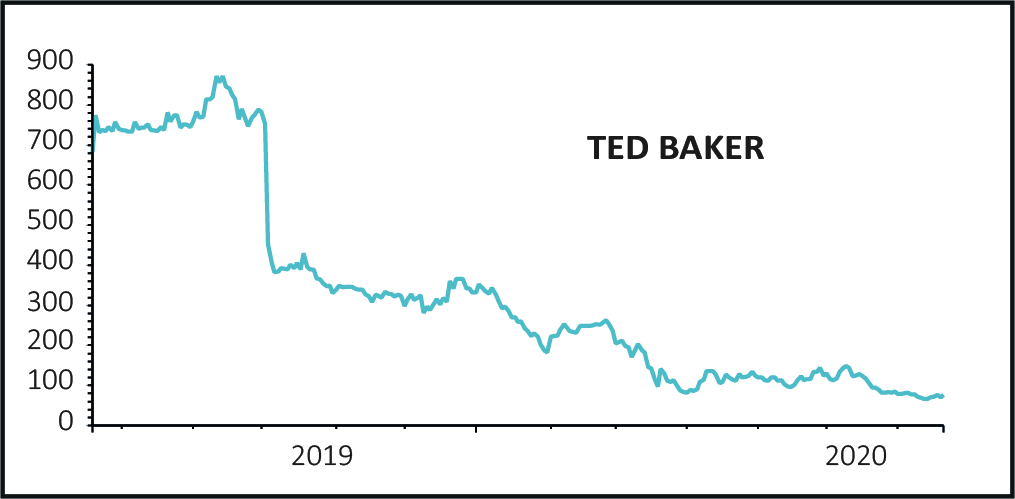

Beleaguered fashion retailer Ted Baker (TED) rallied 12.2% to 79.2p as new chief executive Rachel Osborne flagged early progress under her turnaround strategy and highlighted a ‘resilient’ performance over the 11 weeks to 18 July.

Admittedly group sales plunged 55% over the period, although this reflected pandemic-induced store closures and was actually ahead of the base case scenario provided with June’s full-year results.

Ted Baker’s better than expected net cash balance also encouraged fans of the bombed-out stock on Tuesday.

SHUTTERED DREAMS

Today’s annual generating meeting (AGM) update from the quirky British fashion label, whose recent troubles Shares chronicled here, revealed a 55% slump in group revenue to £60.9 million.

A 79% plunge in stores revenue came as no surprise given global outlet closures and was partially cushioned by better than expected 35% online sales growth.

Having begun a controlled re-opening of stores across Europe, North America and the UK in late April, 95% of Ted Baker’s global store estate was open for business as at 18 July. For the last four weeks of the period, like-for-like store sales were down a whopping 50% versus last year.

EARLY TURNAROUND PROGRESS

Osborne flagged good progress against ‘Ted’s Formula for Growth’, her three year turnaround plan designed to deliver a structurally more profitable business with higher return on capital employed (ROCE) and higher sustainable free cash flow generation.

Encouragingly, net cash of £56.7 million as of 11 July was also ahead of management expectations thanks to decisive actions to conserve cash and slash spending and with the balance sheet strengthened by Ted Baker’s recent rescue fundraising.

Osborne labelled the performance as ‘resilient, with a particularly strong performance online’ and explained Ted Baker has ‘taken a more dynamic trading stance since the beginning of the year, reflecting more sophisticated cross-category merchandising, refreshed social media activity and increased marketing spend.’

The new broom commented: ‘Our performance is encouraging, but I caution that it is still early days, and we have a substantial amount of work to do over the next 12 months against a backdrop of significant uncertainty in the world.’

Liberum Capital described today’s missive as a ‘very good update with clear deliverables’.

The broker commented: ‘The balance sheet is fixed and has £56.7 million of cash, significantly ahead of expectations. The restructuring and efficiency programmes are underway and the company has increased guidance on cost saving targets.

'Current trading is ahead of the base case too. The delivery against very clear targets and more immediate milestones highlights a clear direction from the new management team.’