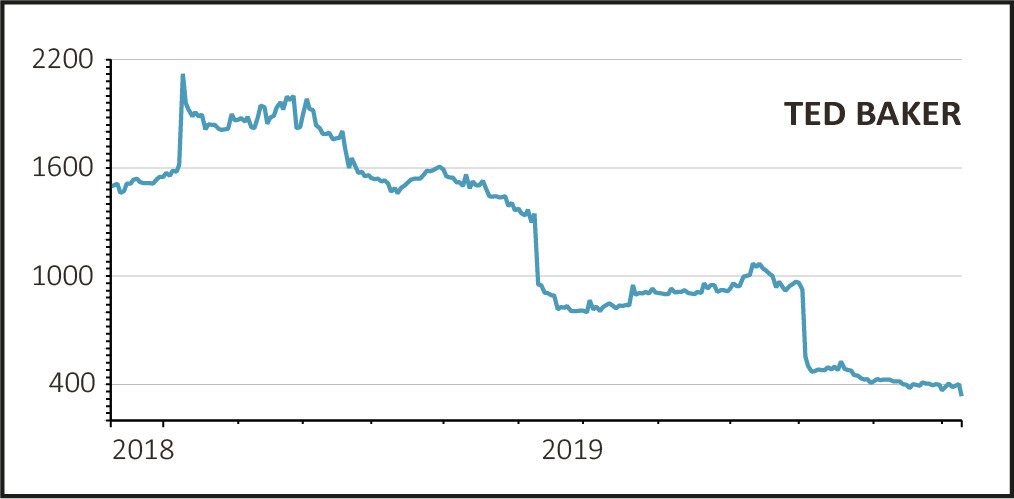

Shares in embattled fashion retailer Ted Baker (TED) slumped 15% to 340.2p on Tuesday as the fast-fading fashion label warned on profits yet again following disappointing November and Black Friday sales.

The retailer also rattled investors by suspending its dividend and said chief executive officer (CEO) Lindsay Page and executive chairman David Bernstein had both stepped down with immediate effect.

YET ANOTHER DOWNGRADE

Ted Baker’s pre-tax profit expectations for the year ending 25 January have been reduced to a minimum of £5m, with a potential outcome of up to £10m depending on Christmas trading.

Camden-headquartered Ted Baker is truly having the nightmare before Christmas as weak consumer confidence dampens sales and unprecedented levels of competitor discounting depress margins.

TED BAKER UNRAVELS

The latest shocking trading update revealed retail sales fell 5.7% in the 17 weeks to 7 December with Ted Baker’s gross margin also coming in below expectations. It follows the departure of founder and CEO Ray Kelvin, a string of profit warnings and a recent £25m inventory blunder.

READ MORE ABOUT TED BAKER HERE

Page’s position appeared untenable given that the inventory mistake related to prior years when he was finance director. Chief financial officer Rachel Osborne has stepped in as acting CEO with a search for Page’s permanent successor to begin in the New Year.

Ted Baker has also hired independent consultants Alix Partners to conduct a wide-ranging review of its operational efficiency, costs and business model.

WHAT THE EXPERTS ARE SAYING

Liberum Capital believes that the departure of Page and Bernstein are ‘both signals that swift action is being taken. We do believe Ted Baker remains a strong brand going through its worst year but as with all periods of pain, if the right decisions are made then it could come out of this a much better business.’

AJ Bell investment director Russ Mould said: ‘There were some rumours earlier this year that Mr Kelvin may take the business private in order to regain control, given that he already owns 34.87%. It feels like each passing day since his departure creates an opportunity to buy even cheaper given how the share price has plummeted.

‘The business appears to be unravelling with accounting issues and potentially product issues given how Ted has gone from being a retail superstar to one very much out of fashion. And that’s not forgetting Mr Kelvin’s alleged inappropriate behaviour towards staff.

‘If you thought Julian Dunkerton had a big challenge in trying to reset fashion retailer Superdry (SDRY), imagine what it will take to sort out Ted Baker. It seems there is a complicated web of problems to navigate before trying to establish exactly what’s gone wrong.’