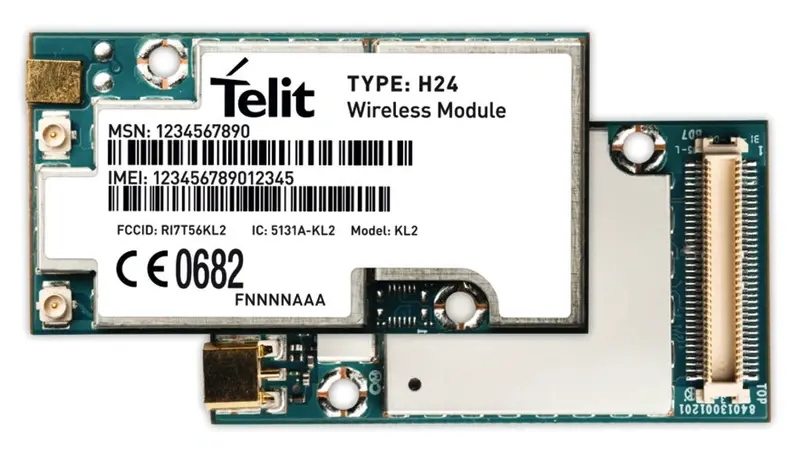

Perhaps the most salient facet of a first quarter trading update from machine-to-machine (m2m) technology developer Telit Communications (TCM:AIM) is that barely anybody seems to have noticed. Short, sweet and to the point, you can read it for yourselves here.

For me, the key takeaway is the rapid progress at its m2mAIR arm. Its $1.2 million of revenues between January and March are its first, and that looks pretty fair going from a standing start just nine months back, something I drew to the attention of Shares readers at the time (read here, page 7). As I noted then, m2mAIR is about expanding the product suite while at the same time developing reliable, monthly recurring revenues from data use, connectivity and analytics. Telit already has 550 customers, and you can expect those numbers to rise rapidly with pilots running with around another 500 possible buyers.

In essence, Telit is bang on track to match market expectations of 20%-plus revenue growth to $237 million (according to broker Canaccord), implying pre-tax profit of $23.5 million and about 9¢, or 5.81p, of earnings per share (EPS). What's not to like? Yet the shares barely moved, nudging just 0.5p up to 85p. One can only speculate how the market might have reacted to a 17% hike in three-month sales at, say, Renishaw (RSW).

OK, let's not allow ourselves to become entirely rose-tinted, as Telit has its challenges. For a start, average selling prices for module kit have fallen 16% a year for the last two, on average. That said, it doesn't seem unreasonable for prices to be supported by upgrades to 3G and 4G modules down the line, especially as m2m applications become data/analytics richer. Another encouraging sign was robust organic growth of about 13% last year against the low single-digits at key US rival Sierra Wireless (SWIR:NDQ).

Canaccord estimates that the US firm put up just 4% organic sales growth in 2012, once you strip out its Sagemcom acquisition. Cash generation has been weak, something to watch out for, but a 2013 price/earnings (PE) multiple of 14.6, falling below 10 next year, could be seen as a bargain for a company with increasingly reliable earnings and the potential to dominate an estimated $1.7 billion industry.