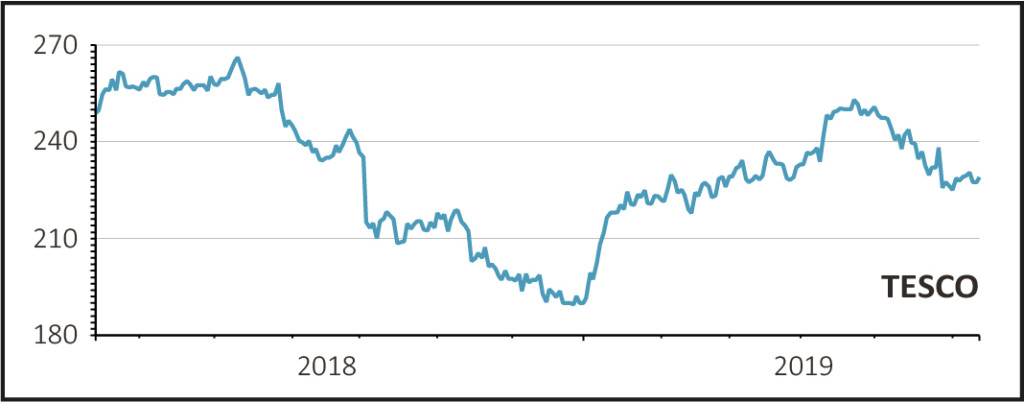

Shares in Tesco (TSCO) are up 1% at 230p after the supermarket giant reports group sales for the 13 weeks to 25 May up 1.3%, ahead of the market as measured by IRI Retail Advantage but in line with the Kantar figures for the similar period, which we reviewed here.

READ MORE ABOUT TESCO HERE

On a like-for-like basis UK sales were up 0.4%, mid-way between analysts’ forecasts of zero and 1%, as the company invested more in its range, prices and loyalty scheme.

GROWTH ALMOST ACROSS THE BOARD

The stand-out category from a sales point of view was fresh food, where Tesco outperformed the market in prepared products as well as bakery and dairy.

Considering how strong sales were in May last year, thanks to record temperatures which boosted demand for beer and ice cream, and the royal wedding celebrations, the sales performance this May was encouraging.

Tesco has been driving volumes by rolling out its ‘Exclusively at’ range to more stores, helping lift sales by 10% across the range, and by offering extra discounts to holders of its Clubcard.

Online sales are also growing at a strong clip, up 7%, with more customers choosing Click & Collect, while sales at Booker were up 12.4% on an overall basis and 3.1% on a like-for-like basis, well ahead of the overall market.

The Asian business, which made up around 9% of group sales in the quarter, grew turnover by 3% thanks to increased market share in Thailand. However the Central European business, which also accounts for around 9% of group sales, under-performed with turnover down almost 8% due to weakness in Poland and poor weather across the region.

TOUGHER QUARTER TO COME

Despite a good report overall and a positive like-for-like result, we doubt that analysts are likely to change their full year forecasts.

Still to come is the second quarter, where the comparison with last year will be even tougher as hot weather and the World Cup helped to lift like-for-like revenues by 4.2% at the group level and by 2.5% in the UK alone.

Tesco is holding a capital markets day early next week (18 Jun) so there may be more news in the pipeline. Having announced that it is withdrawing from the new mortgage market and is exploring options to sell its existing mortgage book, the market will be keen to hear of any new strategic initiatives.