A first half trading update from oil services firm Petrofac (PFC) is not getting a great reception from the market despite the company just about hitting expectations.

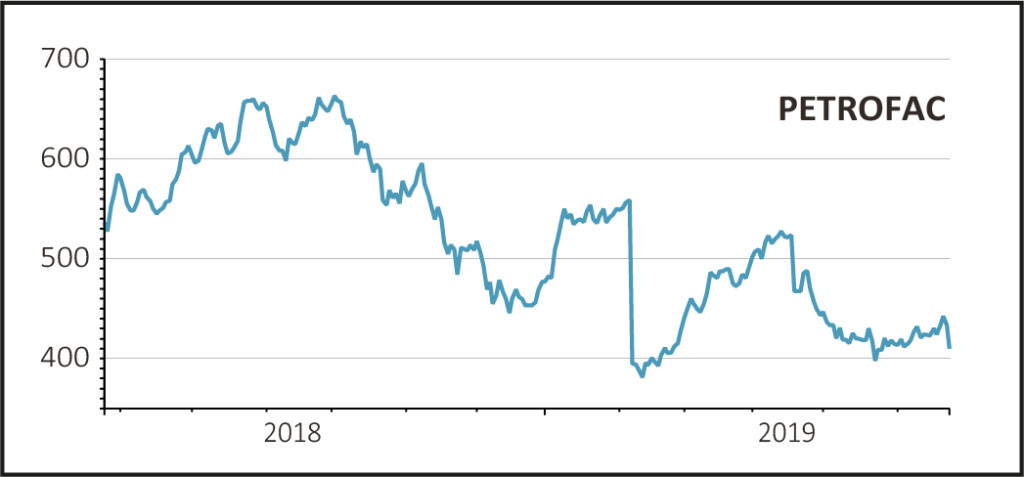

The shares are down 5.2% as 411p as investors focus on declining order intake. This makes sense given it has implications for future revenue and profitability.

The company also expects annual margins at its engineering and construction business to be at the lower end of its guidance range.

WHAT IS EXPECTED

Engineering and construction revenue for the full year is expected to be around $4.5bn.

The separate engineering and production services division is performing in line with expectations, with growth in projects offsetting lower activity from operations.

READ MORE ON PETROFAC HERE

In the integrated energy division, net production was expected to be around 2.1m barrels of oil equivalent (mmboe) for the first half of the year, down from 3.1 mmboe), in line with expectations and reflecting divestments in the second half of 2018.

ORDERS DOWN

Overall new order intake for the year to date stood at $1.7bn, down from $1.8bn for the same period a year ago. Cantor Fitzgerald says this is ‘reflective of challenges in Saudi Arabia and Iraq’.

The company will report its first half results in full on 28 August. Cantor adds that the company is ‘just about keeping up with expectations, although the slowing order intake will concern investors’.