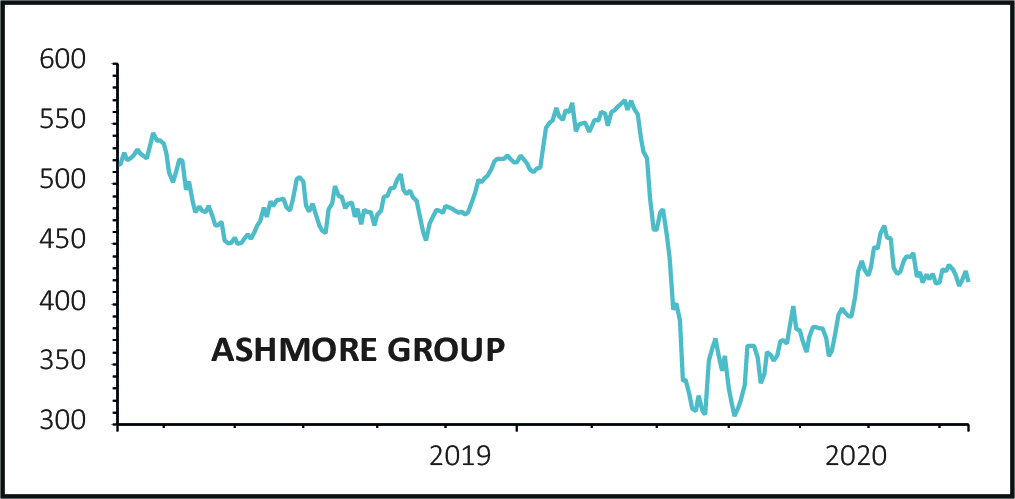

Investors were not sold on news of an increase in Ashmore’s (ASHM) assets under management (AuM) as the stock fell 1.5% to 421.4p.

The emerging markets specialist reported a rise in AuM in the quarter ended June, as a recovery in markets boosted investment performance.

For the three months through June, assets under management increased by $6.8bn, reflecting positive investment performance of $9bn. However, the firm disappointed with net outflows of $2.2bn.

'The global macroeconomic outlook remains uncertain, and the experience of individual countries will vary considerably, but it is increasingly apparent that the emerging markets in aggregate are less likely to suffer a recession as severe as that in the developed world,' the company said.

'Meanwhile, current valuations are discounting a different scenario with emerging markets assets trading at significantly more attractive levels than the equivalent developed world bond and equity markets,' it added.

'LAG' IN INSTITUTIONAL DECISION MAKING

Numis analyst David McCann commented: ‘We believe that in the short term, the underperformance, positioning of funds and macro uncertainty will likely remain a headwind to net flows, noting also that the lag effect of institutional decision-making is only likely starting to kick in now and could continue for a period. We do not think this is priced in or widely expected.’

His counterpart at Shore Capital, Paul McGinnis, said: ‘Near term relative performance has slipped over the last 6-12 months and, while some of this was recovered in the quarter, almost all of Ashmore's strategies are behind benchmark over one and three years, with some leakage into five year numbers.

‘This is not uncommon as Ashmore’s investment committee has a good track record of adding risk when it views extreme price dislocations as overdone, albeit it can lead to initial periods of underperformance. These periods can also coincide with its largely institutional client base pulling funds (often as part of a wider asset allocation decision).’

READ MORE ABOUT ASHMORE HERE