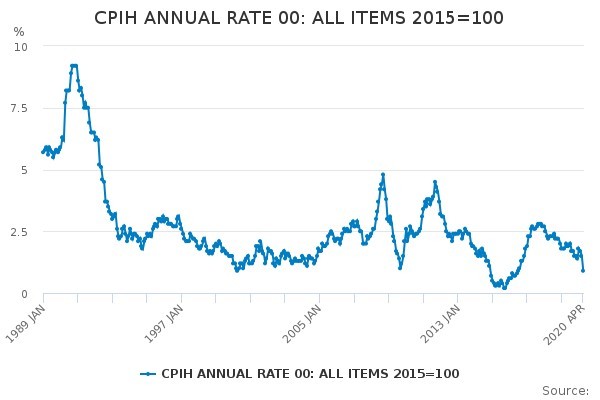

The UK consumer price index fell to 0.8% in April, down from 1.5% in March, according to the latest data from the Office for National Statistics. This compared with market expectations for a fall to 0.9% and represents the lowest rate since August 2016.

The collapse in energy prices associated with global lockdown conditions was a major contributor to the fall. Reduced demand for clothing and footwear, with people stuck at home also contributed to falling prices.

The EY Item Club, a leading economic forecaster, reckons inflation could go as low as 0.3% although its chief economic adviser Howard Archer flags that ‘sterling remains relatively weak and this may have some limiting impact on the drop in inflation’.

The lower inflation number arguably gives the Bank of England more flexibility to consider negative interest rates - a possibility previously acknowledged by its newly installed governor Andrew Bailey.

NEGATIVE RATES

The chief economist at research house Redburn, Melissa Davies, says: ‘As we move from the lockdown weighing on pricing to generally weak demand and higher unemployment, downward pressure on inflation is likely to persist. This gives the Bank of England a clear rationale to move interest rates into negative territory to combat upward pressure on real interest rates.’

Lower inflation is in theory good news for people with cash on deposit in the bank. AJ Bell personal finance analyst Laura Suter says: ‘The inflation news does provide a boost for savers, who for the first time in ages can now get above inflation interest rates on easy-access savings accounts - from more than one account.

‘However, the past few weeks have seen a sea of cuts from providers, following the Bank of England’s base rate cut and competitors cutting their rates.

‘This means that these inflation-busting savings rates are likely to vanish quickly - with the exception of NS&I, which recently reversed its planned cuts to rates.’