There is a lot of positive news in the latest annual results from Wagamama owner Restaurant Group (RTN) that may have caught investors by surprise, sparking a share price rally of 8.4% to 137.2p.

Like-for-like sales are up 2.8% in the 10 weeks to March 2019. Wagamama’s sales increased by 9.1% in the 12 weeks to 3 February. Restaurant Group has outlined plans to potentially cut the number of Frankie & Benny’s sites by a third, and it travel outlet sites and pubs are experiencing strong growth.

While there is no news on who will replace Andy McCue as chief executive - he recently gave in his notice for personal reasons - the full results do give the impression of a more confident business with clear plans for growth.

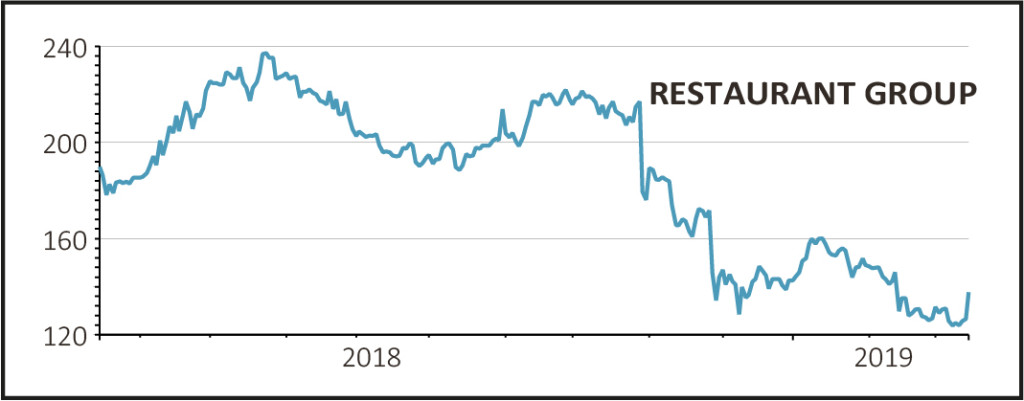

That will be welcome news to shareholders who have seen the value of their investment decline by a quarter over the past year.

Restaurant Group’s full year results look mixed on paper but you have to remember that the story is focused on the future and these figures are history.

Like-for-like sales fell 2% in the year to 30 December 2018 and pre-tax profit dropped from £57.8m to £53.2m, but the latter was slightly better than analysts’ forecasts.

Operating cash flow fell from £107.8m to £88.3m in the 12 month period. Net debt ballooned from £23.1m to £291.1m primarily because of the Wagamama acquisition.

Investors will be hoping these figures represent a low point for the business which has struggled for some time with poor service standards, outdated brands and a negative backdrop for the casual dining sector as a whole.

READ MORE ABOUT RESTAURANT GROUP HERE

It is very interesting from reading the full year results how Frankie & Benny’s appears to play a less significant role in its strategy. Previously the company’s flagship brand, the Italian/American-style diner no longer appears core to its growth plans.

Restaurant Group says 31% of its Frankie & Benny’s sites are in ‘structurally unattractive locations’.

‘Fortunately 41% of its leisure portfolio has a lease end or break option within the next five years, giving Restaurant Group the flexibility to action significant change in the near to mid-term,’ says AJ Bell investment director Russ Mould.

Frankie & Benny’s sits within its leisure division where the strategy includes converting some F&B restaurants to Wagamama or closing them. Also in this division is Chiquito where investment has been made to improve operational management and the menu.

The concessions division - various sites within airports and train stations - is getting more attention from management. Sales are outpacing passenger growth and between five and 10 new sites will open in the current financial year.

Wagamama has been owned since 24 December 2018. Some investors were resistant to the acquisition due to the high £559m price tag which has pushed up group debt.

Some analysts were also sceptical of whether Wagamama’s strong trading would continue. Restaurant Group therefore needs to prove that it can keep driving sales growth with this brand while also right-sizing its historical estate.