It tells you something about a company's back story when even a reasonably positive trading update sparks a stampede for the shares. Ubisense (UBI:AIM) stock is currently soaring 29% higher on Friday at 48.5p, valuing the business at about £27m.

For the 2016 full year the company today notes 'good progress in terms of revenue growth, margins, cost management and order book,' with all better than 2015, driven particularly by the RTLS division, or Real-Time Location Services.

But even its own broker Numis has no forecasts in the market, showing how much of a guessing game Ubisense results have become.

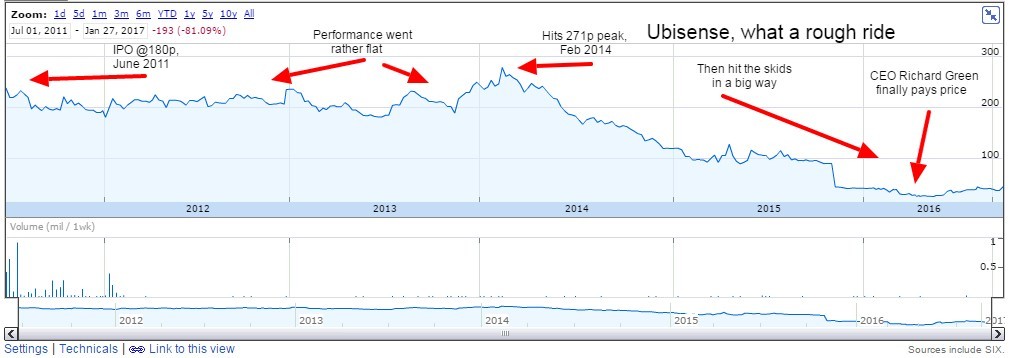

The Cambridge-based tracking technology specialist provides wide area mobile masts monitoring for big telcos (Geospatial division) and vehicle, parts and tools tracking inside manufacturing plants for car makers (RTLS). Sadly, it's been grappling with delayed orders, slow implementation and poor revenue visibility almost from the off of its 2011 IPO at 180p, when the business commanded a market cap of £38.6m.

'For the record, 2015 revenues and EBITDA losses were £22m and £5.2m respectively, with revenues up marginally and EBITDA losses down substantially for the first half of 2016,' Philip Carse says today, analyst at IT research boutique Megabuyte.

'It is normally this time of year when Ubisense admits to having undershot expectations for the previous calendar year,' Carse states today. 'This time, there are no market expectations as such to be measured against, but at least the business appears to be making progress on all the key metrics, aided by the removal of long time CEO Richard Green last May.'

Green was effectively axed last May, the Caterham 7s race-loving boss paying the price for sustained poor performance. His replacement, Richard Petti, took the hot seat in December.

'The company also expects to report a net cash position for December 2016, suggesting that it has avoided burning through the £4.8m raised last April.' Avoiding yet another cash call would be a measure of success in itself, but there remain far too many imponderables to get very excited at this stage.