Kitchen floor-to-bathroom wall tiles retailer Topps Tiles (TPT) climbs 5.6% to 103.5p on well-received final results and evidence of a strong pick-up in recent trade. The £187.8 million cap reports its first annual pre-tax profit growth in six years.

Shares in the home improvement retailer have had a strong run on hopes it will see dramatic sales and margin improvements as the housing market picks up. Potential upside from self-help initiatives and cost-cutting measures has also fostered optimism towards the UK's largest tile and wood flooring specialist.

Today's full-year figures to 28 September show group sales flat at £178 million and like-for-like sales down 0.5%. Encouragingly however, adjusted taxable profits increase 2% to £13 million (2012: £12.8 million) in-line with consensus. Significantly, this is the first increase in adjusted pre-tax profit delivered by Topps since it generated a bumper £40 million profits haul in 2006.

With net debt decreased to a better-than-forecast £36.6 million (2012: £45.6 million), Topps confidently lifts the final dividend from 0.75p to 1p for a 1.5p total payout (2012: 1.25p).

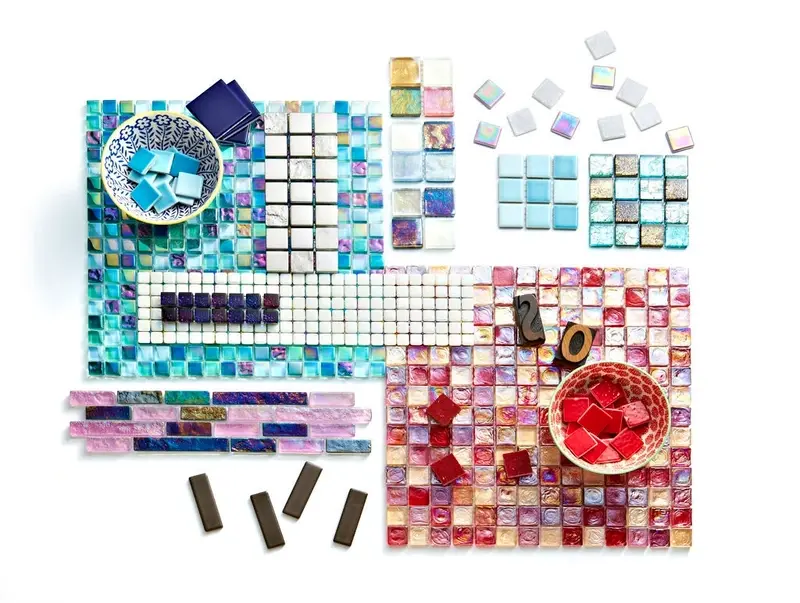

Amid challenging conditions for all consumer-facing businesses, Topps Tiles managed to increase UK tile market share to 28.5%, up from 27% a year ago. Chief executive officer Matthew Williams attributes these gains to the retailer's deep and broad product range as well as the convenience of its multi-channel offering, while gross margin gains reflected supply chain efficiency and cost-cutting initiatives.

Another key catalyst behind today's share price rise is the news that like-for-like sales skipped 7.4% higher in the opening eight weeks of the new financial year. Given that like-for-like sales grew a paltry 1% at the comparable stage last year and were but flat in the fourth quarter, Topps is clearly seeing a pick up in trade as the housing market returns to form.

Stockbroker N+1 Singer, with a 'hold' rating and 85p price target for Topps, writes that 'after numerous forecast downgrades over the past 12-18 months we hope today's reported increase in profitability signals a change in direction in terms of earnings momentum.' Yet the broker adds: 'We still harbour some concerns that competition from other specialists (physical and online) and the 'sheds' is building and could be disruptive.'

Indeed, Shares has previously noted the emergence of new market entrant Tile Mountain, a small-but-ambitious online tile specialist founded by a team of key former Topps and Tile Giant management. Unfettered by a large store estate, Tile Mountain plans to dramatically grow product line numbers. As consumers become more comfortable buying bathroom, kitchen and floor tiles online, Tile Mountain could disrupt the market and take a large chunk out of Topps' online sales.

At Sanlam Securities UK, with Topps Tiles selling on a high teens price/earnings ratio, analyst Amisha Chohan believes that 'some of the potential benefits from growth in the UK housing market are already priced into the shares'.