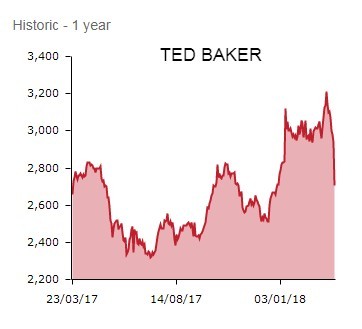

Quintessentially British fashion brand Ted Baker’s (TED) full year profits have come in slightly below consensus estimates, causing shares in the stock market star turn to tumble 6.1% to £27.58.

The clothing-to-accessories seller warns trading conditions ‘will remain challenging across many of our global markets’ and bemoans ‘the recent unseasonal weather’ in Europe and across the pond, which has dampened down sales of its Spring/Summer collections.

CHALLENGED OUTLOOK

In today’s current trading and outlook statement, Ted Baker cautions: ‘The recent unseasonal weather across Europe and the East Coast of America has had an impact on the early part of trading for Spring/Summer and we anticipate that external trading conditions will remain challenging across many of our global markets.’

Ray Kelvin, founder and CEO, however stresses that its new collections have been received positively.

‘Although we anticipate external trading conditions will remain challenging across many of our global markets, the strength of our brand and business model mean that we remain well positioned to continue the group’s momentum and long-term development.’

ANYTHING BUT UGLY

Investors are evidently spooked by the softer outlook, yet in the context of the current struggles of rival British retailers, Shares views results for the year ended 27 January as impressive.

Group sales are up 11.4% to £591.7m - retail sales up 10.4% to £442.5 including a strong online showing and wholesale revenue up 14.6% to £149.2m - adjusted profit before tax skips 11.7% higher to £73.5m, albeit below consensus closer to £75m.

Brand strength and pricing power helped Ted Baker maintain a gross margin north of 60%, while the dividend is also raised 12.1% to 60.1p, which sends confident signals from management.

Kelvin insists Ted Baker remains well positioned to continue the group’s momentum and long-term development.

‘We have a clear strategy for the continued expansion of Ted Baker as a global lifestyle brand across both established and newer markets. This is underpinned by our controlled distribution across channels as well as the design, quality and attention to detail that are central to everything we do.’

While domestically-focused UK retailers are struggling, Ted Baker, with origins as a specialist shirt store in Glasgow, benefits from being a global lifestyle brand with 532 stores and concessions worldwide - we highlighted the stock’s attractions in a feature recently.

Ted Baker’s designs are distributed through retail outlets, leading department stores and independent stores in the UK and Europe, North America, the Middle East, Africa, Asia and Australasia.

Brokerage Canaccord Genuity writes: ‘Taking account of the full year 2018 miss, the difficult start to the year and foreign exchange becoming a headwind, we expect consensus pre-tax profit of £83m for full year 2019 to fall by circa 2-3%.

‘A nudge down to forecasts at the start of the year is uncharacteristic of Ted but, we think, symptomatic of tough markets more than anything else.’

Meanwhile Liberum Capital has trimmed its earnings forecasts in reflection of what is a tougher backdrop in UK and Europe.

The broker says: ‘Furthermore weak footfall dynamics across the UK are persistent and in line with the broader market, meaning a more cautious stance is appropriate.

‘Ted Baker should continue to outperform the market though as it has proven track record and this is being delivered due to its agile and flexible model with more latterly a significant contribution from e-commerce.’