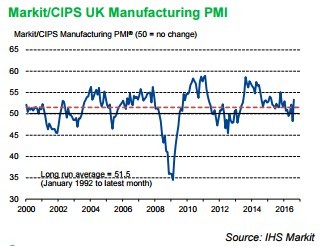

Manufacturing in the UK has rebounded to an impressive 10-month high in August, according to Markit’s purchasing managers’ index (PMI).

The index has recovered from a 41-month low of 48.3 in July following the EU referendum to 53.3.

The FTSE 250 has jumped 0.6% as investors’ confidence in the UK’s future economic growth grew.

Companies have reported solid inflows of new work from domestic and export sources, which was supported by the weaker pound.

Sales volumes have improved to the US, Europe, China, South East Asia, the Middle East and Norway, while manufacturing production rose at the fastest pace in seven months in August.

In response to the positive data, the pound has strengthened by over 1% to around 1.18, while housebuilders are trading higher in hopes of strong construction data on Friday.

Chartered Institute of Procurement & Supply CEO David Noble says: ‘Fuelled by a combination of export and domestic orders, the increase in the level of the headline PMI equalled its best during the survey’s quarter of a century history.’

However, the depreciated currency has resulted in input price inflation as over two fifths of firms reported higher purchasing costs.

Derivatives platform XTB is impressed by the rebound following the ‘knee-jerk’ reaction after the EU referendum, which hit construction stocks heavily.

'Since the knee-jerk reaction following the EU referendum which saw economic indicators contract sharply last month, today’s number represents an impressive rebound ahead of the construction and services reading in the coming days,' says XTB markets analyst David Cheetham.

The analyst believes improved readings from the construction sector will challenge overly pessimistic views of Brexit critics.