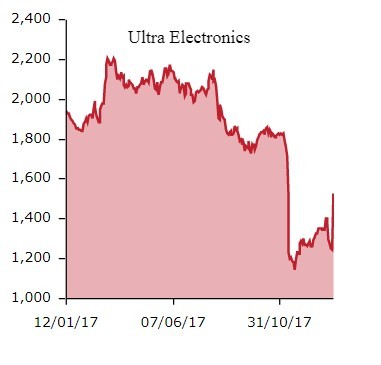

FTSE 250 defence contractor Ultra Electronics (ULE) saw its share price soar 18% to £14.73 on Thursday, topping the FTSE All-Share leader board. Behind the surge is a trading statement that outlines strong forward orders and an improving cash performance.

But, arguably, the biggest reason is pure and simple relief that no further skeletons have fallen out of the cupboard.

A HUGE SIGH OF RELIEF

In November 2017 Ultra's stock collapsed from over £17.00 to below £12.00 after a the company spooked investors with a hefty profit warning. The company blamed lower spending by the UK's Ministry of Defence (MoD).

What is improving the mood of investors is greater confidence that vast US defence spending will continue.

It's no surprise that Douglas Caster, executive chairman and acting chief executive, points out Ultra's ‘significant exposure to the strengthening US defence budget and growing demand for advanced defence technologies’.

The company also says claims good visibility on future earnings, backed up by forward orders worth ‘just under £900m’.

WHAT CITY ANALYSTS ARE SAYING

An analyst at broker Liberum says that many investors were expecting ‘skeletons to emerge following weak first half cash then the profit warning and departure of the CEO.’

That assessment now appears to have been too gloomy.

Cash conversion is expected to be above 90%, the company says, presumably of earnings before interest, tax, depreciation and amortisation (EBITDA). That implies a much improved outcome on the 80% steer given in November.

Investec analyst Rami Myerson agrees, saying that today's statement will offer comfort to beleaguered shareholders. His highlights are ‘orders, cash and the outlook’.

REVENUE WILL STILL BE DOWN

Putting today's news into context, investors should note that 2017 revenue and operating profit will still be below 2016 comparatives.

2017 revenue is expected to be more than £770m, although it seems unlikely to match the £786m reported in the year before. While underlying operating profit (just over £120m) will likely be around 8% to 10% lower than 2016's £131m.

VALUATION CONUNDRUM

Based on Investec’s forecasts, Ultra shares are trading on 13.3-times 2018’s 110.8p of earnings per share. Estimated dividends imply a 2.4%.

These forecasts do not include the Spartan deal, which will make Ultra the sole supplier of sonobuoys (submarine trackers) to the US Navy, which is still awaiting regulatory approval.

Both Investec and Liberum claim that the share price is too cheap at current levels, with Investec's Merson’s stating that the stock is ‘simply the wrong price’.

For the time being, the market begs to differ.