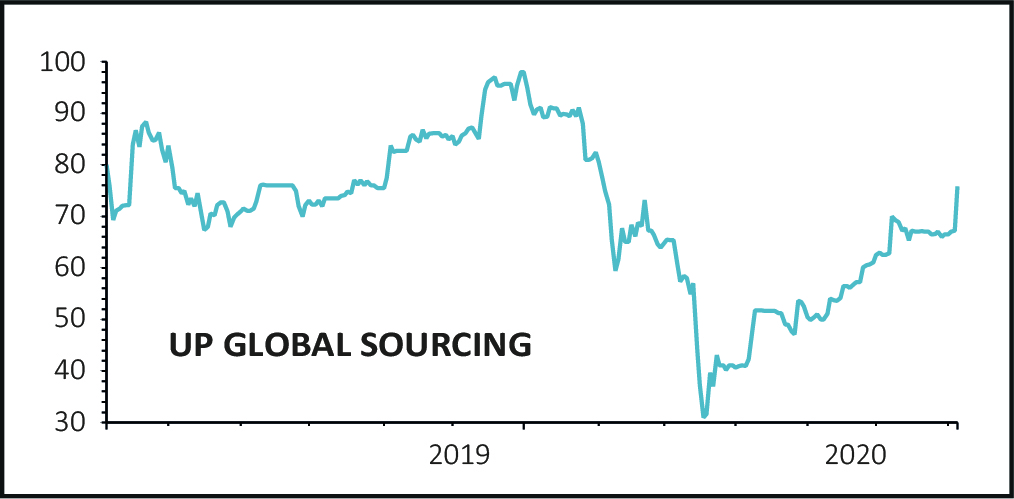

Shares in value focused consumer goods company UP Global Sourcing (UPGS) flew 12% higher to 75.4p after releasing a strong unscheduled trading update for the year ended 31 July 2020.

Today’s announcement followed quickly on the heels of an 8 June update where the Oldham-headquartered group said its order book had progressed at a steady pace with invoiced revenues of £97.2 million, and another £10.6 million in the pipe, leading to full year expectations of £107.8 million.

This prompted UP Global Sourcing to upgrade earnings before interest, tax, depreciation and amortisation (EBITDA) above market expectations.

Revenues are now anticipated to be above £111 million with underlying EBITDA above £9.6 million, around 8% and 25% respectively higher than consensus market expectations according to data compiled by Refinitiv.

Chief executive Simon Showman commented, ‘we are pleased to be making better-than-expected progress against a backdrop that remains hugely uncertain and challenging. The investment that we have made in our online segment in recent years is delivering particularly good results, and our adaptive, resilient and flexible business model is standing us in good stead.’

VISIBILITY REMAINS LOW

House broker Shore Capital has upgraded forecasts for revenues to £112 million and EBITDA to £10 million, leading to net debt to EBITDA of 0.9 times. The broker believes strong online trading will be a feature of second half trading leading to higher gross margins, though they ‘note the higher operating costs to fulfil such sales.’

Low visibility on trading post lockdown prevents the broker from providing 2021 forecasts.