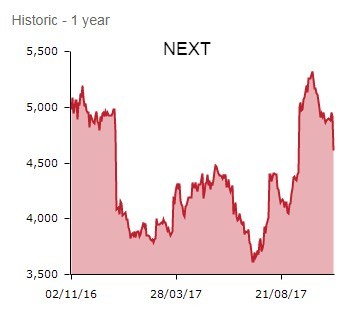

Fashion-to-home furnishings giant Next’s (NXT) shares are taking a battering, as the high street bellwether’s third quarter sales miss expectations.

CEO Simon Wolfson (pictured below) issues a pessimistic outlook for the key fourth quarter including Christmas, basically conceding management has no clue how sales will pan out over the peak selling period.

‘Week by week sales volatility makes it very hard to determine any underlying sales trend’, warns Next, this absence of visibility shaking investors’ confidence and forcing the shares a further 7.5% south to £45.53.

SETTING THE BAR LOW

Volatile sales patterns mean Next’s best guess is fourth quarter (Q4) full price sales will be in line with the year-to-date, so down 0.3%. This number is at the mid-point of the sales guidance given alongside September’s half year results, so Next is sticking with the central profit before tax guidance of £717m.

At the time, Next modestly upgraded profit guidance following a promising start to the third quarter.

However, the range is narrowed from £687m-to-£747m to £692m-to-£742m, meaning the jeans-to-jackets purveyor’s profits will be down by between 6.1% or as much as 12.4% in what is proving an exceptionally tough year for retailers.

This guidance from the reliably cautious Wolfson, who prefers to under promise and over deliver, implies Q4 sales will be down 0.3% against tough prior year Christmas comparatives.

This is disappointing news considering sales grew 1.3% in the third quarter thanks to product range improvements.

LOTS OF VOLATILITY, ZERO VISIBILITY

Next notes third quarter sales performance ‘has remained extremely volatile and is highly dependent on the seasonality of the weather.'

Cooler temperatures boosted sales of warmer clothes in August and September, yet ‘the change in sales trend came at precisely the same time UK temperatures became warmer than last year.’

After a decent start, Next encountered four poor weeks in October which reversed much of this improvement. Once again, there’s a stark contrast between the performance of brick and mortar stores and online.

Neil Wilson, Senior Market Analyst at ETX Capital, explains: ‘In terms of sales, it’s very much more of the same - Retail suffering and Directory doing all the heavy lifting.

Retail sales fell 7.7% in Q3, in lock step with the trend for the year to date but significantly worse than was expected for the quarter (consensus was around -3.7%). Directory sales are accelerating - up 13.2% for Q3 and 9.4% year to date.

As ever when talking about Next’s problems in growing sales amid a tough retail market, the business remains strongly cash generative even if it’s not expanding rapidly and is able to maintain solid returns to investors.’

Over at UBS, Andrew Hughes sticks with his ‘buy’ rating and £50 price target. ‘We retain PBT of £725m,’ says Hughes, ‘although the biggest swing factor remains the weather. Full year earnings before interest and tax (EBIT) margins are expected to be -140 basis points, a mix of lower gross margin in both divisions, negative operational gearing in Retail, and a swing in sales towards the higher margin Directory business.'

Investors can however draw some comfort from Next’s reliably strong operational cash flow and shareholder returns. The retailer is mid-way through its £50m share buyback, and has declared a fourth special dividend of 45p per share.