Colour cosmetics supplier Warpaint London (W7L:AIM) warns full year profits will disappoint due to a further softening of its important UK market.

The lipstick, eyeliner and face creams seller’s overseas sales are growing strongly, but international progress won’t be enough to 'make-up' for a domestic sales shortfall.

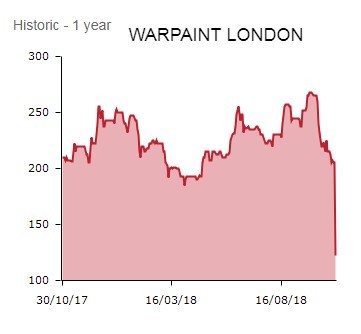

Many small cap investors are wiping the shares from their portfolios on the news, with Warpaint crashing 40% lower to 122.5p.

WATCH OUT FOR SECOND HALF WEIGHTINGS

Buckinghamshire-based Warpaint London owns the W7 affordable cosmetics brand as well as the Technic, Body Collection and Man’stuff brands added through last year’s acquisition of Retra, a supplier of white label cosmetics to Asda and Matalan.

Eagle-eyed investors may already have spotted the potential for a profit warning at the interim results stage. Last month, the cosmetics merchandiser placed emphasis on a heavy second half sales weighting and the importance of Christmas gifting sales in meeting annual market forecasts.

LATEST CONSUMER IPO TO WARN

Today, joint CEOs Sam Bazini and Eoin Macleod warn sales for the calendar year will be ‘in the range of £48m-to-£52m’, while pre-tax profits are set to weigh in at between £8.5m to £10m.

Edison Investment Research analyst Paul Hickman says Warpaint ‘joins a growing list of recent consumer IPOs that have had to warn on profit. Pre-tax profit is now signalled in a range £8.5-£10m, around 25% lower on average than market consensus.'

Speaking for 44% of group sales in the first half, the UK market remains challenging and has softened further recently. Although cosmetics sales have historically shown resilience, with consumers shunning the high street, hard-pressed retailers are reducing stock levels and Christmas orders.

Is Warpaint softening investors up for further profits pain? The company also cautions that ‘the reported level of profitability for the full year will be crucially dependent on the precise product and geographic mix of sales for the remainder of the year, the busiest period of the year for the group.'

‘Whilst the current UK market conditions are challenging we are seeing strong growth in our overseas sales,’ insist Bazini and Macleod, with sales to the USA, the world’s largest colour cosmetics market, and the EU remaining strong and Warpaint having made its first domestic sales into both China and Russia.

‘We remain well positioned to take advantage of any improvement in UK market conditions and will continue our strategy of growing and diversifying our international sales,’ add the joint CEOs. ‘Warpaint is a profitable and cash generative business that is well positioned for continued growth and the maintenance of our progressive dividend policy.’

'The UK market accounted for 44% of (first half) sales and the positive effect of better than anticipated international sales will not fully offset the UK downturn.

‘There may be more - the busiest trading season is still largely ahead, with actual profitability “crucially dependent”, management says, on the precise product and geographic mix of sales.'