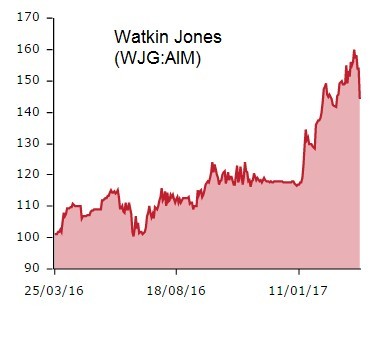

Shares sales are dragging on stock in Watkin Jones (WJG:AIM) today, the share price 6% down to 144.5p. A trust owned by the family behind the student accommodation company, and the chief financial officer (CFO) Philip Byrom, sell a near-20% holding combined for more than £70m.

WHO IS SELLING WHAT?

Watkin Jones says the shares have been placed through stockbroker Peel Hunt to meet demand from new and existing shareholders and to improve the liquidity of the shares.

G&J Watkin Jones 1992 Settlement Trust has sold a combined 19.7% stake in the company. Trustees include chief executive Mark Watkin Jones, Glyn Watkin Jones and Jennifer Watkin Jones.

The trust sold £68.95m worth of shares at 140p. CFO Byrom also sold a £1.4m slug at the same price in a separate deal.

The company joined AIM a year ago and one of the stated reasons for going public was to ‘allow incumbent shareholders to realise a proportion of value’. It is worth noting that Mark Watkin Jones still has an interest of nearly 30%.

We gave our latest view on the investment case here.