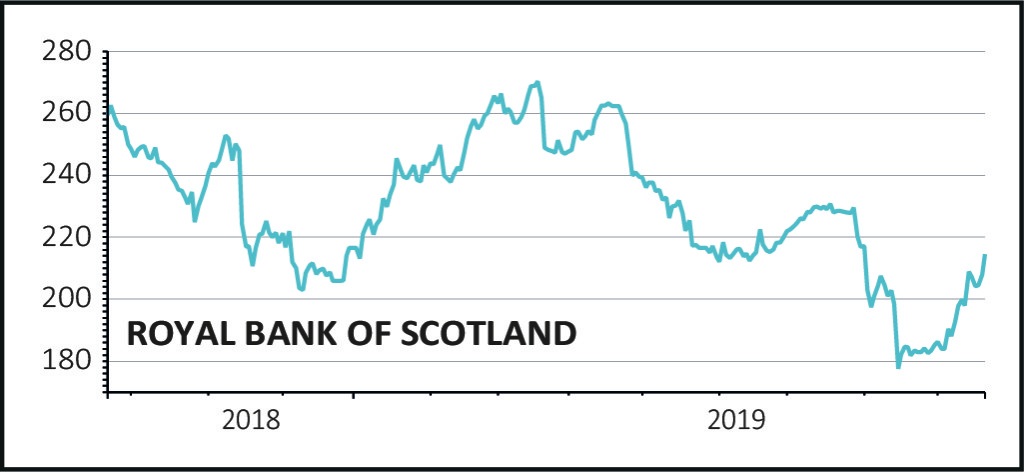

Shares in lender Royal Bank of Scotland (RBS) advanced 2.3% to 212.8p after confirming internal candidate Alison Rose as its new chief executive officer.

As Shore Capital notes, this was expected, with Rose ‘widely viewed as the leading candidate for the role? her appointment should not really come as a surprise’.

BANKING EXPERTISE

Rose, a 27-year veteran of the bank who joined as a graduate, is the current head of its commercial and private banking business. She becomes the first woman to head up a big British bank.

She is also currently deputy chief of Natwest and will assume her new position on 1 November after Ross McEwan formally stands down.

New RBS CEO, Alison Rose

READ MORE ON RBS HERE

Chairman Howard Davies says Rose brought ‘extensive experience and a track record of success’ from her previous roles at the bank.

‘Following a rigorous internal and external process, I am confident that we have appointed the best person for the job,’ he adds.

Rose said the bank was entering ‘a new chapter’ following years of restructuring under McEwan.

LIFE POST-RESTRUCTURING

AJ Bell investment director Russ Mould considers what this new chapter might involve. He says: ‘McEwan achieved the milestone of returning RBS to the dividend list, and Rose will be looking to leave her own mark.

‘One of the key challenges will be managing the transition back to full private ownership - a tricky task given the remaining 62% Government stake.

‘It is also worth considering that a potential Labour-led administration might look to keep the bank in public hands to use it as a vehicle to support domestic economic growth.

‘Rose also faces a likely challenge from the economic fallout associated with Brexit, in particular the risk of a spike in bad debts.’