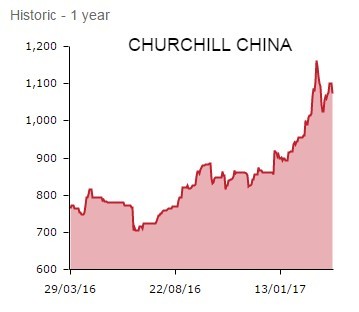

Forecast-busting 2016 results and another round of earnings upgrades demonstrate ceramic tableware maker Churchill China (CHH:AIM) continues to make terrific progress.

Yet shares in the Potteries-based company cheapen 27.5p (2.5%) to £10.73, Churchill’s stellar run interrupted by the cautious tenor of the UK outlook.

Click here to pore over results for the calendar year from the Stoke-on-Trent-headquartered ceramics manufacturer prized by small cap growth and income investors alike.

These reveal better-than-expected pre-tax profits, up 28% to £6.6m with a helping hand from sterling weakness.

Achieved purely by organic means, sales grew 9% to £51.1m too, strong export growth in the hospitality division leading the way. The total dividend is once again raised, this time by 15% to 21.1p, underpinned by Churchill’s plump £12.7m net cash pile.

MANAGING EXPECTATIONS

Typically, earnings upgrades stoke share price gains on the day of results, yet Churchill China has established a track record of under-promising and over-delivering.

Accordingly, management prudently points out ‘the progress we made during the year was faster than we originally expected with profit growth ahead of long term average levels’ and also sounds a note of caution on the UK outlook.

‘As we expected, progress in the UK has been more difficult to sustain as hospitality market growth has slowed,’ says Churchill China.

‘The rate of opening of new hospitality outlets has reduced and there is less clarity in relation to future growth prospects. We have retained our market leading position and continue to benefit from long term replacement sales.’

EXPORT STORY STOCK

The reassuring news is exports are growing everywhere from Germany, Italy and Spain to North America and the Middle East, while Churchill’s shift towards higher margin added value ranges, being products offering pubs, hotels and restaurants technical performance benefits and differentiated ranges, is paying off handsomely.

‘The rate of progress of new product sales across our markets has exceeded our expectations, with our hand-crafted Stonecast range becoming our most successful product in the three years since its launch,’ adds Churchill China.

DUE A BREATHER

N+1 Singer writes: ‘Whilst we do not anticipate Churchill to repeat a stellar 2016, we expect it to have a solid year. We expect this once again to be led by the export business.’

‘New product development looks strong with initial uptake of two new ranges (Homespun and Raku) positive. UK is likely to remain flat as operators continue to be cautious, despite the fact the eating out market in Jan/Feb has been resilient.’

Based on forecast earnings of 51.1p (2016: 48.6p), Churchill trades on a punchy prospective price-to-earnings ratio of 21 times, but the broker reckons ‘the premium is merited on fundamentals and growth criteria.

‘Whilst the share price is due a breather, we see scope for further upside on a 12 month view.'