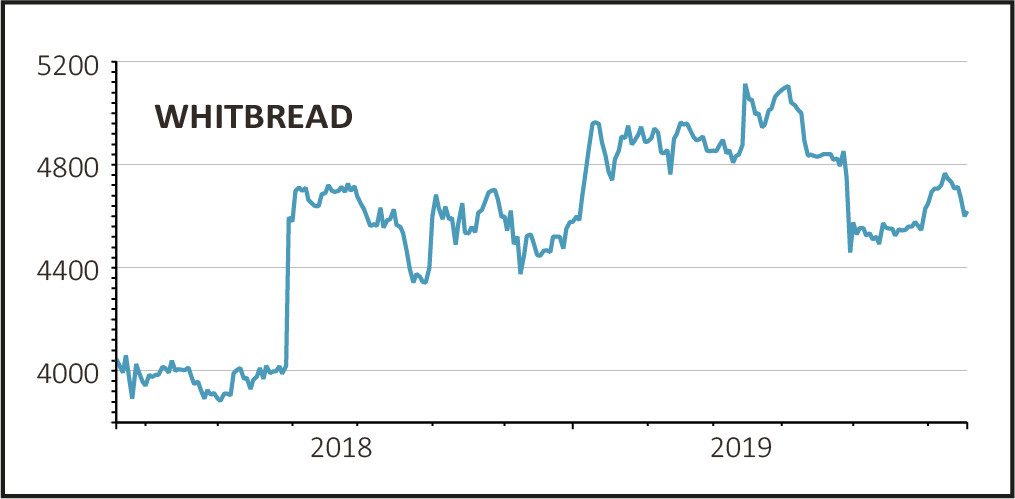

Shares in Premier Inn owner Whitbread (WTB) are trading sideways at £46.08 after a 1.3% drop in early morning trading following what analysts have called ‘very soft’ first quarter results.

Like-for-like sales growth in the UK was down 3.7% overall - down 4.6% in its accommodation business and 2.1% in food and beverages - compared to a 0.6% decline the previous quarter.

READ MORE ABOUT WHITBREAD HERE

Total sales were down 1%, while the 1.5% drop in UK accommodation sales was put down to weak trading conditions, which Whitbread blamed on ongoing political and economic uncertainty primarily due to Brexit.

ANALYSTS DISAPPOINTED

Despite the drop being in line with expectations, analysts are still disappointed by the results.

Canaccord Genuity analyst Nigel Parson said part of Whitbread’s problem has been its regional hotels performing worse than London, and business custom not doing well with the ‘short-lead, midweek business traveler becoming a scarcer species.’

Canaccord forecasts a 3% decline in revenue per available room (RevPar) - a key metric to determine how good hotels are at filling their rooms - to £47.46 for the current financial year and a 2% decline to £46.51 next year.

Parson added that every one percent change in RevPar will impact profit by £12m-£15m, and that lower room rates, rather than lower occupancy, will account for most of the decline.

Shore Capital analyst Greg Johnson called Whitbread’s Q1 results ‘very soft’ and highlighted the 6% drop in like-for-like RevPar in its Premier Inn business as a concern.

GERMAN OPPORTUNITIES

But Whitbread is sounding a more upbeat tone going forward, and while CEO Alison Brittain says she is ‘cautious about short-term market conditions’ she remains ‘confident in our plans given the significant growth opportunities in the UK and internationally’ for the Premier Inn brand.

The company expects to open 3,000-3,500 new rooms in the UK during the year and 2,000 rooms in Germany.

Shore Capital views the return of up to £2 billion to shareholders as ‘providing some support’ for the stock in the near-term.

But it adds: ‘Beyond that, it is a tussle between the property backing (c£54 fair value on a full split) and the long term opportunities in Germany, against a soft trading backdrop and the dilutive near-term returns from its international expansion.’