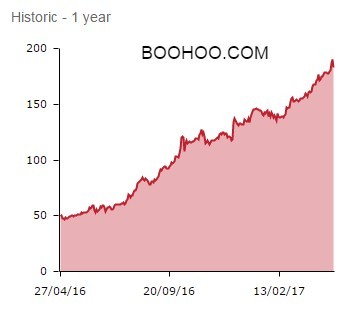

Pure-play online fashion retailer Boohoo.com (BOO:AIM) struts in with better-than-expected full year results and upgrades guidance yet again. However, the high-flying shares retreat 6.75p to 183p as investors, who’ve grown accustomed to significant upgrades, take some profits off the table.

You can flick through the phenomenal figures for the year ending 28 February from the private investor favourite here. These confirm Boohoo has strong momentum both at home and overseas.

Total revenue is up 51% to a forecast-busting £294.6m. Manchester-headquartered Boohoo also reports a surge in profit before tax to £30.9m (2016: £15.7m) and closed the year with a bumper £58.4m net cash in the coffers.

Sales growth of 45% to £283.4m at boohoo.com is impressive, including UK sales up 33%, Europe up 50%, the USA 140% ahead and the Rest of World up 40%.

MULTI-BRAND BUSINESS

During a momentous year, Boohoo morphed into a multi-brand online retailer, acquiring a 66% stake in PrettyLittleThing (3 Jan), then bagged the Nasty Gal brand (28 Feb) and customer list.

‘Both brands have huge potential and the acquisitions represent a step change in the size, structure and operation of the group,’ comment joint CEOs Mahmud Kamani and Carol Kane. ‘We are confident that our expertise combined with the strength and following of our new complementary brands will greatly enhance the group’s future growth and profitability.’

Boohoo also issues an upbeat outlook statement. ‘Trading in the first few weeks of the 2018 financial year has made a promising start and we are excited about the prospects of our development into a multi-branded business,’ say Kamani and Kane. ‘We expect group revenue growth approaching 50% over 2017, which includes growth from the recent acquisitions, and a group EBITDA margin of approximately 10%.’

CAUSE FOR CONCERN?

One mild negative is a 330 basis point drop in gross margin to 54.5%, although this reflects Boohoo’s strategy to lower prices and improve the customer proposition to drive its stellar sales growth.

Risk-averse investors may also be concerned by the recent dip in retail spending in the UK, boohoo's largest market, although the retailer clearly continues to flourish on home turf.

THE ANALYSTS’ VIEW

N+1 Singer’s Matthew McEachran has a ‘hold’ rating on Boohoo, the share price having passed through his 145p target price two months ago. He writes: ‘Today’s figures are clear evidence of both Boohoo’s successful business model and growth strategy, with pre-tax profit and earnings per share doubling in full year 2017, circa 2% better than forecast. The balance sheet remains strong with unchanged net cash of £58m despite the acquisition and increased capex spend.’

Yet the analyst also cautions: ‘Management has taken a lot on with the opportunistic acquisition of the latter, so we are relieved that guidance is prudent as they manage any execution risk and establish the platform for future growth. A lot of the recent re-rating has been well justified but we wonder if the market was hoping for a sizeable upgrade today.’

However, Liberum says the highly rated shares are ‘factoring in faultless execution’ and adds that ‘while our move to a hold back in November has clearly proved to be the wrong call, we retain this view despite our favourable outlook on the group’s long term prospects.'