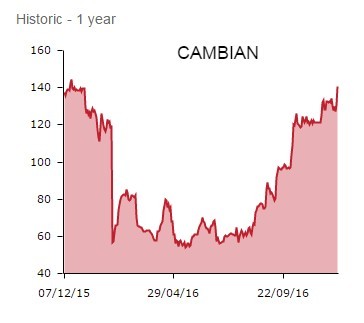

Behavioural health service provider Cambian (CMBN) is to sell its adult care business for £377m to an American operator in a compelling deal returning the business to much ruder health.

The proceeds will repay its current debt in full and have £40m left over to fund a special dividend for shareholders, welcome news which sends the shares up 7.1% to 140p.

COMPELLING DEAL

Founded in 2004, Cambian provides schools, hospitals and specialist care homes for adults and children suffering from high severity behavioural or mental health problems.

Today, the social care provider announces the sale of its adult care services unit to Cygnet Health Care, part of American hospital management company Universal Health Services (UHS:NYSE), for what looks like a good price.

Reflecting high levels of interest in the business, the consideration represents an enterprise valuation of 2.9 times the unit's 2015 sales of £129.5m and approaching 16 times annual EBITDA.

CRUCIAL FINANCE BOLSTERING

Crucially, the deal leaves Cambian, which previously ran into difficulties following some overly ambitious expansion, in ruder financial health and free to focus on the roll-out of its Children's Services Business.

Children's Services offers 'significant opportunities for growth, development and the creation of shareholder value' against a backdrop of growing demand for such critical services, according to the board.

'We recently took the strategic decision to develop our Children's Services Business around a differentiated integrated recovery model incorporating care, education and therapy for children with the highest needs,' explains CEO Saleem Asaria. 'The proposed disposal will enable us to focus fully on the development of the business and realise its potential as one of the UK's leading specialist providers.'

Income seekers can also put Cambian back on watch lists. In addition to the special dividend, Asaria says his charge now plans to resume its progressive dividend policy, having suspended the shareholder reward pending a return to growth. A payout is likely to be declared around the time of the half year results in 2017.

Back in September, Cambian put October 2015's profit warning behind it by reporting better-than-expected half year figures, with adjusted EBITDA of £22m eclipsing Canaccord Genuity's estimate by 42% with the help of lower costs.