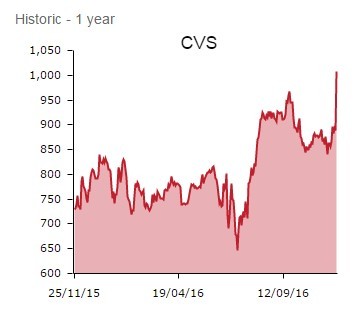

A trading statement stokes double-digit earnings upgrades at CVS (CVSG:AIM), further justifying the veterinary services star turn's punchy rating.

Shares in the vet industry consolidator scurry 11.2% higher to 989p as analysts revise forecasts upwards and deal-hungry CVS insists 'the pipeline of acquisitions remains strong'.

IMPRESSIVE PET PROJECT

In a concise update, chairman Richard Connell flags 6.3% growth in like-for-like sales for the opening four months to October.

This is an impressive showing indeed from CVS, confirming the momentum seen in last financial year's second half has been maintained in a market with proven defensive characteristics.

'Gross margins have improved and underlying profitability for the period to 31 October 2016 is ahead of the board's expectations,' enthuses Connell.

N+1 Singer's Sahill Shan feels it is too early in the year to assume this strong sales trend will continue, flagging a stiff second half growth comparative (6.6%), the risk a bad winter hurts trade and the well-documented pressure on consumer discretionary income next year.

'Nevertheless, we see scope to nudge up our 2017 financial year like-for-like assumption from 3.7% to 4.5%. Post factoring in the new acquisitions and a higher gross margin assumption, we lift our three year earnings per share (EPS) by a meaningful 10% for each year,' writes Shan.

'The strength of the update shows CVS continues to have strong momentum and we argue for fair value towards £11.00,' adds Shan, now forecasting a leap in taxable profits from £24.9m to £31.1m this year.

That should set earnings bounding higher from 31.7p to 39.8p, which leaves dividend payer CVS swapping hands for the best part of 25 times forward earnings.

Cash generative CVS continues to consolidate a fragmented niche market. Since the start of the financial year on 1 July, the company has made eight acquisitions of 18 surgeries bringing the total number of sites to 378.

Recent M&A on home turf has expanded CVS' geographic footprint, further developed its large animal, equine and small animal businesses.

'Particularly exciting is our first acquisition in The Netherlands. Kliniek voor Gezelschapsdieren Dieren is a high quality, small animal practice based in the east of the Netherlands. It is intended that this acquisition is the start of the development of a business in The Netherlands on a similar basis to the CVS Group in the UK,' he explains.