Pizza delivery chain Domino’s Pizza (DOM) is still experiencing ‘growing pains’ in its international operations amid a slowdown in UK store openings as it tussles with franchisees.

International system sales rose 7.7% when currency fluctuations are stripped out in the year ending 30 December 2018.

Operations in Switzerland, Norway and Sweden have remained loss-making, prompting pre-tax profit to fall 22.2% to £61.9m.

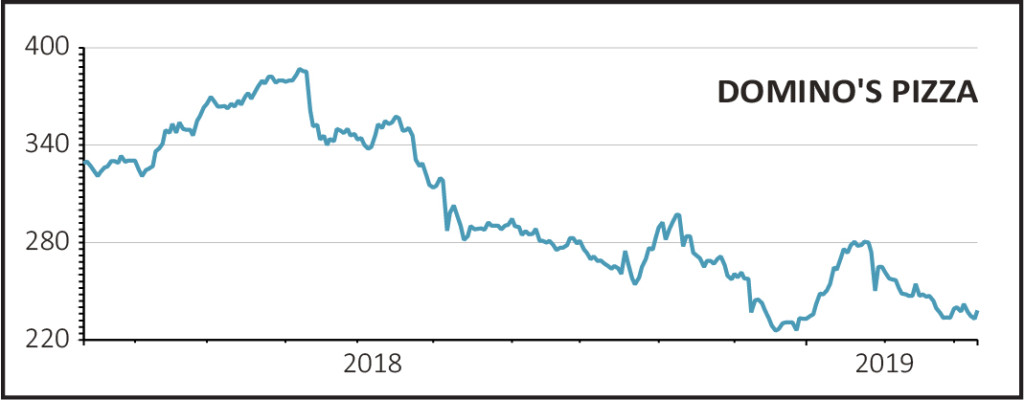

The firm's issues overseas and with franchisees are not new and had already been flagged, helping to explain why shares in Domino's have risen 2.1% to 238p after an initial decline.

READ MORE ABOUT DOMINO'S HERE

Domino’s has been forced to recognise £14.1m in impairment charges from its overseas loss-making operations, mainly due to past underperformance and higher risks.

In a bid to boost performance and help its overseas operations breakeven by the end of 2019, the pizza delivery company is investing in new stores and improving its capabilities.

WHY ARE FRANCHISEES UNHAPPY?

Back in the UK, Domino’s has delivered a 4.6% jump in like-for-like sales in 2018, but this may not continue amid warnings store openings are likely to be lower than last year.

AJ Bell investment director Russ Mould says the firm’s decision to split geographical territories means new stores may be less profitable, which is a big issue as franchisees face rising costs.

‘As such, franchisees have joined forces to lobby for a greater share of profits,’ comments Mould.

Mould says investors may face more bad news, flagging a lack of commentary on current trading and no share buyback despite the stock trading near a four-year low.

Share buybacks are typically an indication a company thinks the stock is undervalued.

Canaccord Genuity’s Nigel Parson says analysts’ expectations for this year are not expected to ‘drop materially’ but believes lower store openings may dampen growth beyond 2019.