In short, it's the sort of copper-bottomed company that just does not let you down. One of Britain’s unsung success stories, Halma (HLMA) has earned its nickel-backed reputation for (almost) never putting a foot wrong, and that makes it a rare reliable growth and income story in the technology space.

Manufacturing and selling globally a wide range of health and safety equipment largely demanded by health, safety and environmental rules, and changing demographics (people living longer etc), these tools include hazard detectors, sensors and assorted environmental protection kits. This allows the £3.9 billion Amersham-based company to consistently perform almost regardless of the economic cycle.

Today's first quarter trading update lends huge confidence that it can, and probably will, continue to do so for years to come, presuming a minted foreigner does not sweep it up with the pound in A&E. The market largely agrees, the shares barely budging at £10.36 to maintain what many believe is a deserved premium rating.

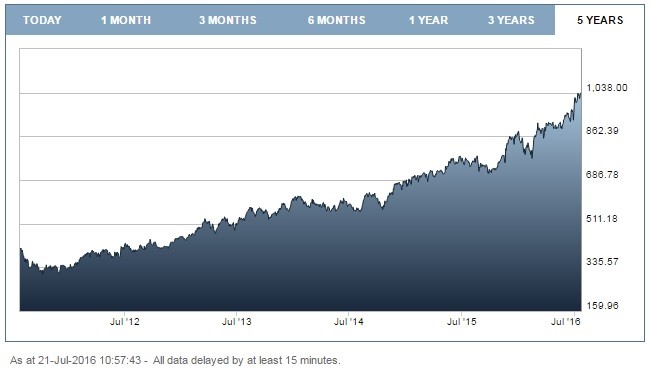

Just look at the five-year share price chart.

Revenue in three months to 2 July implies very decent organic growth (details are limited but analysts speculate mid-single digits) and the outlook notes confidence in resilient and global growth drivers, flexibility within its various businesses to adapt to changing market conditions, and a pipeline of acquisition opportunities.

Numis analyst Nick James has more detail. 'Order intake was ahead of revenue and also above order intake versus the first quarter of the prior year,' he notes. 'Divisionally, there was strong growth in Infrastructure Safety and Medical sectors with steady progress in Environmental & Analysis, but as expected lower revenue in Process Safety. Process Safety has seen improving order intake trends and continued diversification, positioning it for better performance as the year progresses.'

Gas detection kit, Halma

The model simply works. Halma is very careful in how it chooses its business areas, seeking resilient growth drivers based on advances in safety regulations, the growth, ageing and urbanisation of populations, and other demographic trends. It also buys businesses that generate strong returns and which it can help to develop and spread in to new geographic markets.

'This has produced a virtuous circle of reliable growth and cash generation that pays for the next stage of investment, and for an unrivalled record in dividend growth,' point out Investec's Michael Blogg and Chris Dyett.

The operations are not entirely immune from macroeconomic factors, but close management allows Halma to react very quickly and effectively when necessary. For this investors must pay a full price. This year's (to 31 March 2017) price to earnings (PE) multiple stands at 27.3-times consensus anticipated 38p earnings per share (EPS), falling to 25.3 next's year's 40.9p estimate.