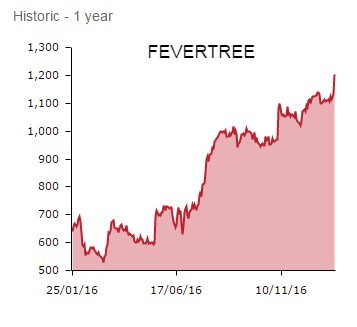

Premium carbonated mixers marvel Fevertree Drinks (FEVR:AIM) continues to serve up bombastic growth rates, confounding any naysayers waiting for sales rates to slow and also justifying a frothy valuation, trading as it does on a prospective price-to-earnings ratio approaching fifty times.

In its latest trading update, the soft drinks star turn says the strong growth delivered in the first half of calendar 2016 accelerated in the second half. Consequently, full year results will be 'materially ahead' of management expectations (yet again), news that sends the shares fizzing 5.8% higher to £12.01.

PALATE-PLEASING GAINS

Click here to read the short-but-sweet missive from the high-end tonic water-to-ginger ale supplier, in which co-founder and CEO Tim Warrillow flags a tasty 75% year-on-year leap in second half revenue.

That takes full year sales to around £102.2m, so 73% growth on 2015, and coaxes another round of earnings upgrades out of analysts who'd only nudged numbers northwards as recently as November.

Investec Securities' Nicola Mallard for instance lifts her full year taxable profits estimate by 12% to £34.8m (2015: £17.5m) for earnings of 24.1p (2015: 12.1p), while the well-followed scribe's target price increases from £11.40 to £13. For 2017, Mallard looks for £36.5m of pre-tax profit for earnings of 25.1p.

Shares recently outlined the scope for additional upgrades in an article here, arguing consumers would splash out on high-quality mixers to complement vodka, gin and whisky over the festive period.

GLOBAL GROWTH APPEAL

Enjoying shoot-the-lights-out growth over Christmas in the UK, market share gains secured with major supermarkets as well as bars, hotels and restaurants, Fevertree is also a big overseas earner. Riding a renaissance in the popularity of gin, Fevertree achieved rip-roaring revenue growth in Continental Europe, the USA and Rest of World regions last year.

Also engendering the feel-good factor is news Fevertree closed the year with a plumper-than-predicted net cash pile. An asset-light outsourced production model means the business is extremely cash generative and offers a progressive dividend.

'Fever-Tree continues to pioneer and lead the premium mixer category. We believe the global opportunity remains in its early stages and will continue to be supported by the long term premiumisation of the spirits sector as well as the growing movement towards mixed and long drinks. As a result, the Board remain confident of the future outlook for the business.'

For more background on Fevertree, read our Griller interview with Warrillow from late 2015 here.