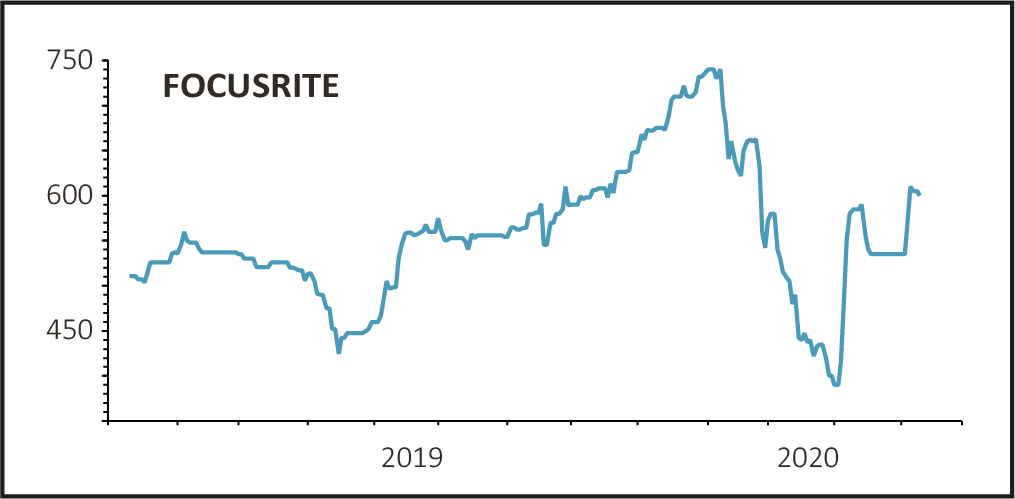

Shares in music and audio products play Focusrite (TUNE:AIM) boogied 7.1% higher to 680p on Friday following news sales and profits for the year ending 31 August 2020 are likely to beat market expectations.

Demand for the group’s Focusrite Audio Engineering and ADAM Audio products has been strong during the lockdown, with sales driven through e-commerce platforms rather than brick and mortar stores, while the decision to pay an interim dividend sent a confident signal too.

MAKING THE RIGHT NOISES

High Wycombe-headquartered, with offices in Berlin, Nashville, Dongguan, Los Angeles and Hong Kong, Focusrite supplies hardware and software used by professional and amateur musicians and the entertainment industry alike.

In an update that hit almost all the right notes with investors, the AIM-listed company said market expectations for the year through to August were likely to be exceeded, with revenue and profits tracking ahead of management’s internal expectations at this stage of the financial year.

LOCKDOWN BOOST

Demand for its Focusrite Audio Engineering and Adam Audio products has proved strong during the COVID-19 lockdowns thanks to their widespread global availability through e-commerce platforms.

‘Consumer registrations of products primarily focused on home recording equipment have risen, indicating increased consumer demand,’ enthused Focusrite, whose fortunes are guided by chief executive Tim Carroll.

‘This has, in turn, led to increased reseller demand from the group.’

However, Focusrite did caution that ‘moving forward, it is expected that demand for these products will revert to a more normal level as the lockdowns ease.’

Demand for Martin Audio products has been significantly lower than pre-pandemic expectation levels due to the suspension of live music tours and festivals, although demand on that front is now starting to show modest signs of recovery driven by the installed sound segment.

DIVIDEND DECISION

At the interim results back in May, Focusrite’s board deferred making a decision to pay a half year dividend due to the obvious prevailing uncertainties.

However, the positive recent cash flows generated by the company has given Carroll and co the confidence to pay an interim dividend of 1.3p, up a healthy 8.3% on the prior year.