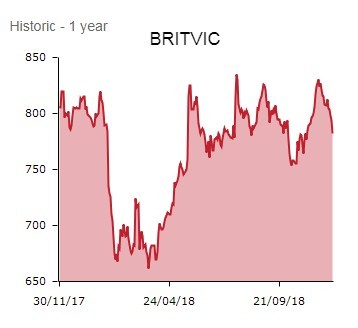

Branded soft drinks business Britvic (BVIC) fizzes 5.4% higher to 825p on forecast-beating full year results demonstrating solid momentum in the business.

Britvic is certainly proving to be an increasingly agile operator in a resilient category. In the year to September, it successfully navigated numerous challenges including the sugar tax, a prolonged winter and then a temporary industry CO2 shortage during fizzy-drinks-demand-driving hot weather.

FREE CASH FLOW FIZZ

Investors are guzzling down the stock on news the beverages group’s already-enviable free cash flow will increase ‘materially’ in 2019 as capital spending reduces to more normal levels. Meanwhile, broker Shore Capital expresses confidence its forward forecasts are ‘at least underpinned’ and hints estimates could move higher given the earnings momentum in the business.

Britvic, whose own brands include Fruit Shoot, Robinsons, Tango and J2O, reports solid results for the year ended 30 September. Sales were up 5.1% to more than £1.5bn with organic revenue 2.7% ahead and the progressive dividend payer puts up 5% growth in pre-tax profit to £145.8m.

LOW & NO SUGAR PROVIDE THE JUICE

The FTSE 250 index constituent, which also produces and sells PepsiCo brands such as Pepsi, 7UP and Lipton Ice Tea in Great Britain and Ireland, sold over 2.4bn litres of soft drinks in the period, up 1.6% year-on-year.

And in terms of the divisions, GB Carbonates grew sales 4.9% in spite of the summer CO2 shortage, benefiting from the shift to low and no sugar drinks; in particular, the Pepsi MAX brand continued to win market share.

GB Stills was also in growth, with Robinsons and J2O offsetting a disappointing showing from Fruit Shoot. Elsewhere, France had a tough year, while the Brazilian business, facing into macro uncertainties and a squeezed consumer, returned to organic growth in the second half and synergies from the early 2017 acquisition of concentrates and juice business Bela Ischia acquisition are coming through.

CEO Simon Litherland highlights the delivery of ‘a strong performance in a challenging environment, with good revenue, margin and earnings growth’ and also insists ‘the investment in the transformational business capability programme is now nearing completion and is already delivering significant efficiency and commercial benefits. Free cash flow will increase materially in 2019 as capital spend falls back towards normal levels.’

Shore Capital’s drinks sage Phil Carroll is similarly upbeat. He believes Britvic ‘enters full year 2019 with a strong platform from which it can drive growth and now that it is nearing the end of the BCP (Business Capability Programme) where around half the profit benefits have been realised (circa £11m) it gives us confidence that our forecasts going forward are looking at least underpinned if not seeing some upward pressure.'