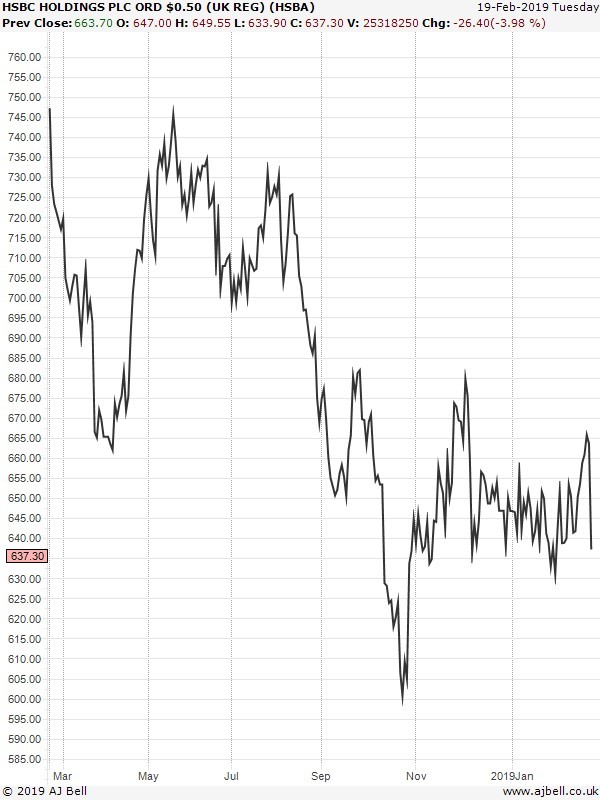

A really disappointing end to 2018 for HSBC (HSBA) adds up to full year numbers short of expectations and is putting the share price under real pressure, down 4.3% at 635.3p at the last count.

That still leaves the banking giant worth around £128bn.

You can read the results for yourself here but one of the key takeaways was that pre-tax profit at $19.9bn is more than $1bn short of the $21.3bn which had been pencilled in by analysts.

Weak financial markets in the fourth quarter of last year hit the investment banking business, while the company is also affected by the US-China trade tensions given its heavy Asian exposure and has concerns about bad debts in the UK.

Shares took a detailed look at HSBC last month and explained why the investment risks were potentially greater than they might appear at first glance.

‘HORROR SHOW’

AJ Bell investment director Russ Mould says: ‘Today’s figures from HSBC are a bit of a horror show for the banking giant with both revenue and profit coming in short of expectations.’

‘Over the longer term the company would expect its exposure to China and Asia more widely to be a positive driver of growth given the more rapid economic expansion than seen in the West, and a less mature financial sector.’

‘In the short term the concerns about a US/China trade war are having an outsized impact on HSBC compared with its rivals.’

BITTEN BY JAWS

Mould notes that the company missed its target of achieving positive ‘jaws’ by the end of 2018. This metric measures income against growth trends in operating expenses and came in at -1.2%.

Analysts have previously cited this as a constraint on the share price.

The company has committed its commitment to the ‘discipline’ of positive jaws today, but this pledge may lack credibility given recent events.

Elsewhere, HSBC’s peer Standard Chartered (STAN), which also has a substantial Asian footprint, is down 3.2% to 608.2p. It reports its own results on 26 February.