Bonding materials specialist Scapa (SCPA: AIM) has pleased investors with its latest full year results, strong trading and a hike in the dividend prompting a 6% share price rise to 456p.

The company has boosted its final dividend by 14.3% to 2p after delivering an 18.2% increase in trading profit to £29.2m for the year to 31 March 2017.

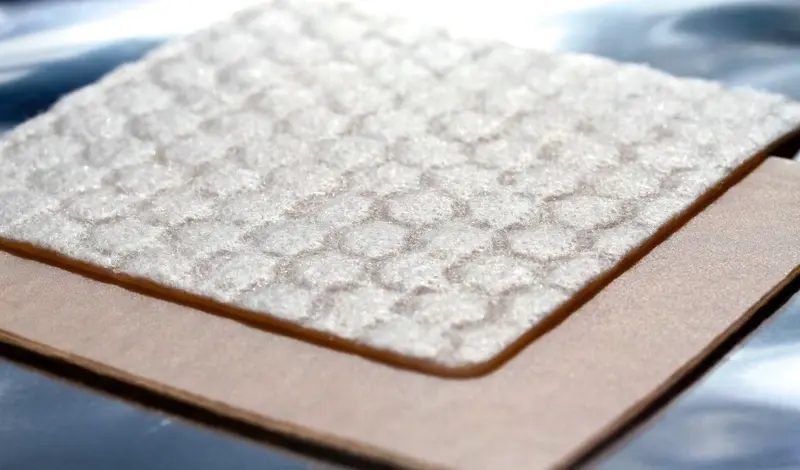

In its industrial division where it sells adhesive tapes, Scapa generated double-digit profit margins of 10.4%, up from 7% in the same period last year and partly due to cost savings.

Scapa also creates finished products using its intellectual property for global companies such as US-listed Johnson & Johnson and Nurofen owner Reckitt Benckiser (RB.).

These companies can get products to market quicker and sell them under their own brand after it has been created by Scapa. The business also outsources sales and marketing to medical device and wound care companies such as ConvaTec (CTEC) and Smith & Nephew (SN.).

In its healthcare division, trading profit is up 4.4% to £16.6m. Scapa wants to focus on this part of the business for further growth and already has £200m of revenue contracted from eight customers.

Numis Securities' analyst Paul Cuddon is impressed with Scapa's strong growth and good visibility of future revenue. He upgrades his earnings per share (EPS) forecast for 2018 by 3% to 16.6p and his 2019 EPS estimate by 5% to 18.4p.

N+1 Singer analyst Jon Lienard is also optimistic and believes the positive momentum is likely to continue, while Scapa's low debt levels mean future acquisitions are also likely.