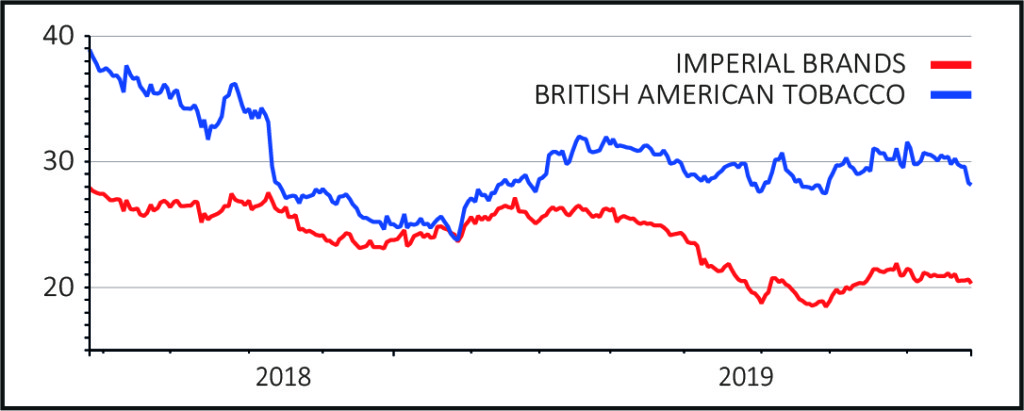

Shares in cigarette giants British American Tobacco (BATS) and Imperial Brands (IMB) cheapened 1% to £28.05 and 1.7% to £20.27 respectively on Wednesday, as the market digested the implications of a tobacco industry mega-merger across the pond.

Marlboro-makers Philip Morris International and Altria have kick-started talks over a US$210bn combination that would help them market each other’s e-cigarettes and increase competition for the London-listed pair’s portfolio of less harmful Next Generation Products (NGPs).

COULD THE ‘REMERGER’ BE DERAILED?

Investors are pricing in the potential for increased competition for British American Tobacco and Imperial Brands.

On Tuesday, Marlboro-owner Altria confirmed it was in talks over an all-share merger of equals that would reunite two industry giants that split up in 2008 amid prevailing regulatory pressures.

Boasting combined sales of a staggering $50bn, both companies are listed on the New York Stock Exchange, although Philip Morris sells the iconic Marlboro and other brands outside of the US, whereas Altria sells Marlboro inside what remains the world’s biggest economy.

Altria also has a 35% stake in disruptive and controversial e-cigarettes upstart Juul Labs, blamed by many for an epidemic of teenage vaping in the US. Philip Morris owns iQOS, a cigarette-esque device that heats rather than burns tobacco.

Significantly, shares in Philip Morris and Altria both declined on the revelation merger talks are afoot. This negative reaction from investors, according to the Financial Times, threatens ‘to derail the recombination of the two tobacco giants’.

According to the FT, Philip Morris investors ‘are worried about US regulatory and litigation issues, which were the main reason the two companies split more than a decade ago, according to analysts and people familiar with investor feedback to the companies.’ Altria investors could be irked by the fact the contemplated deal does not pay them a premium for their shares.

STRUCTURAL CHALLENGES

The tobacco industry is undergoing a seismic shift, with investors alarmed by the structural decline in combustible cigarette volumes, the threat of rising regulation and concerns over the ability of less harmful NGPs - think vapour, heated tobacco and oral nicotine - to replace the dwindling traditional cigarettes profit pool.

Back in 2017, Pall Mall-to-Lucky Strike maker British American Tobacco, the owner of the Vype and Vuse vapour brands, acquired Reynolds American in a £41.8bn takeover that stoked excitement over further industry consolidation.

Smaller rival Imperial Brands, the owner of the myblu vape brand, has long been viewed as a takeover target for a bigger rival, although any deal would likely be a complicated consortium bid.

While the consolidated structure of global tobacco makes it more difficult to get regulatory approval for further mergers & acquisitions (M&A), it also means there are fewer price wars among legal competitors, a trait that supports high profit margins.