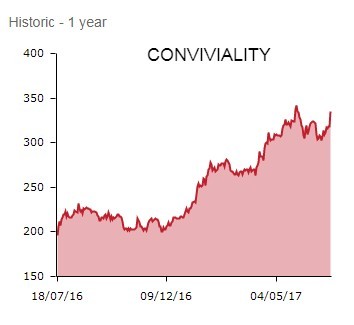

Better-than-expected full year profits and news of robust current trading. That's a heady combination of good news and investors are happy to send shares in drinks wholesaler-to-franchised off-licence operator Conviviality (CVR:AIM) 5.7% higher to 336p on Monday.

Results for the year to 30 April, showing profit before tax more than doubled to £45.8m, are all the more impressive as they were delivered during a period of complex integration work and a worsening consumer backdrop.

Guided by CEO Diana Hunter (pictured below), Conviviality has been transformed via the October 2015 acquisition of Matthew Clark, the UK’s largest drinks distributor to the on-trade and the takeover of wines and spirits wholesaler Bibendum in May 2016.

Sales were up 85% to £1,560m, reflecting a full year from Matthew Clark, a boost from Bibendum and organic growth of 5.8%. Management has also upgraded guidance on synergies from buying and IT efficiencies, which is also going down well with investors today.

CASH FLOW KING

Supplying retailers, pubs, hotels, bars and restaurants with booze, food and tobacco, enlarged Conviviality also reports a dramatic improvement in free cash flow.

This rose from £11.4m to £51.2m last year, taking net debt to £95.7m (2016: £86.1m), a beat versus previous guidance of £99m.

Increasingly prized for its compelling cash generation and income characteristics, Conviviality also raises the full year dividend by 33% to 12.6p.

BUSINESS REMAINS BRISK

Importantly for the forward-looking investment community, Conviviality also reports strong momentum in the nine weeks to 2 July, with June’s balmy conditions likely to have boosted performance.

Sales at Conviviality Direct (Matthew Clark and Bibendum) are tracking 9% ahead of last year, while the Conviviality Retail division, trading as Bargain Booze, Select Convenience and Wine Rack, generated 0.5% growth in like-for-likes with Wine Rack up 4%.

There’s also news of a 7.6% sales hike from Conviviality Trading, the group’s drinks brand and wine agency division that includes acquired outdoor events and festivals business Peppermint.

Consumers’ disposable income is being squeezed with inflation running ahead of wage growth, yet we still believe Conviviality will demonstrate resilience given its sheer scale and broad reach across the UK drinks market. Low prices, notably via the Bargain Booze chain, will give Conviviality the ability to serve cash-strapped consumers with affordable treats.

Shore Capital analyst Phil Carroll reiterates his ‘buy’ rating following the figures.

‘The investment case for Conviviality remains compelling, in our view, with its virtuous circle business model that is more than just a wholesale distribution business,’ the analyst says.

‘We see increased levels of added value throughout the group that is strengthening relationships with customers with scale also being highly beneficial.’

The investment case suggests the potential for both strong earnings growth as well as a re-rating, in our view given the de-risking of the proposition with another set of inline results post the major acquisitions and upgraded synergy guidance helping drive the growth story,’ concludes Carroll.