Online electricals retailer AO World (AO.) issues a year-end update on Friday that insists its loss-making European business has reached ‘an inflection point’.

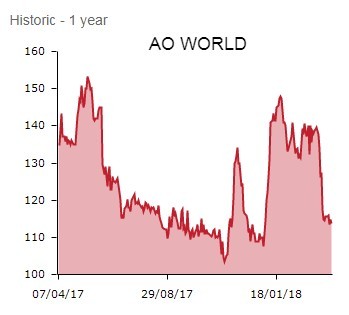

Yet investors are clearly less convinced, judging by the share price reaction. The stock remains largely unmoved in early trading, off a marginal 0.5% to 114.2p.

That means the company is trading on an enterprise value of around £570m, based on forecast year end net cash estimates, hefty for a business that has yet to turn in its first profit.

That's unlikely to change in the near-term given the fierce competition in the electricals space, where big beasts Amazon and Dixons Carphone (DC.) dominate.

Investors appear unconvinced that AO World can put its patchy track record behind it.

CRACKING THE CODE

In today's update AO World says results for the year to 31 March 2018 will fall ‘within the range of current market forecasts’. Such coded language can often imply a performance towards the lower end of a forecast range.

Ahead of full year results (5 Jun), the Bolton-headquartered TVs, tablets and washing machines seller says it expects to report group sales of £796m, representing 14% year-on-year growth.

The company compiled revenue consensus is £794.7m, which AO encouragingly expects to beat, with a range of £773.5m-to-£809.5m.

AO is also guiding towards an EBITDA loss ‘around the middle of the range’. Consensus currently points to a loss of £4.2m, yet the range of between £9.7m to £1.4m is very wide indeed, while Shore Capital has shaded in a £5.4m EBITDA loss.

GROSS MARGIN SUPPORT

Annual revenue for the UK business is expected to have grown 8% to £680m. Encouragingly, AO has positive news on margins, insisting: ‘Growth in Q4 was achieved in what remains a competitive market with limited advertising spend. When compared to this period in the previous year we have undertaken relatively less promotional activity which has supported gross margin.’

In Europe, where it is making inroads into the Dutch and German markets, AO generated impressive 55% top line growth and says ‘our European operations are on trajectory to achieve our targets in these existing territories in full year 2021. As a result of our strong momentum we have now reached an inflection point in the financial performance in these existing Europe operations and expect to see further progress as we move forward.’

This is reassuring for investors, since losses from its European arm wiped out profits from the UK business in the year to March 2017.

COMPELLING THESIS, PATCHY PROGRESS

This perhaps explain why some investors continue to believe AO World has a compelling business model and that the investment thesis stacks up.

They might argue that the company can grow market share in the electricals market as online penetration grows. This effort is supported by keen prices, a huge product range and best-in-class customer service.

Yet this pure-play online retailer has established a poor track record in terms of meeting market estimates since floating on the Main Market in 2014.

‘Overall this is a relatively reassuring post close trading statement that provides comfort to our full year 2018 forecasts,’ thunders Shore Capital’s retail guru Clive Black. ‘As we have previously highlighted management needed to develop a stronger track record of delivering City forecasts year-in year-out, and this statement is a step in that direction, having updated the market in late November.'

Yet Black adds ‘we continue to have concerns around the cash burn of the business and reiterate our sell rating believing that the valuation looks more than up with events.’

While its latest trading update shows revenue growth, the business remains loss making. To its credit, full year treading is expected to hit market forecasts, which is a bonus when you consider AO has a history of missing expectations.

Operations in mainland Europe appear to making progress judging by the company’s comments and a reduction in promotional activity in UK hasn’t stopped sales growth in that territory.

The focus for the next few years will be on the rate of cash burn, essentially how much money the business has to spend to further increase scale and start making a positive return.'