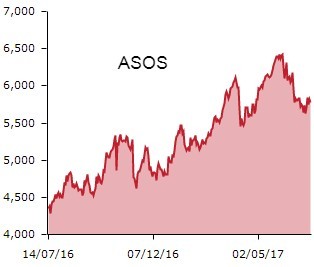

Online fashion retailer ASOS (ASC:AIM) anticipates sales growth to hit the upper end of its 30% to 35% range and in-line full year pre-tax profit in the year to August 2017.

The company also delivers international retail sales growth of 44% and a strong 16% jump in revenue in the UK in the four months to 30 June 2017.

WHAT IS BEHIND THE SHARE PRICE FALL?

The good performance was driven by advances in all areas of the business including retail, technology, warehousing, delivery solutions and customer care.

So why are shares in the company down 1% to £57.48?

There are two key and interrelated reasons for this. First, the update largely in line with what the market was expecting. Second, ASOS trades on a hefty earnings multiple.

Based on consensus forecasts it is on a price-to-earnings ratio of 58.8 for its August 2018 financial year. For this valuation to be justified and the share price to go up it needs to do better than expected.

In the words of a note penned by Canaccord Genuity analyst Sanjay Vidyarthi, 'in line is not enough'. He recommends selling the shares and says ‘tangible signs of margin expansion’ is needed alongside strong sales growth to justify the premium rating.

However, not all analysts share this downbeat view.

BULLISH CALL

Numis analyst Andrew Wade says ASOS is taking advantage of currency movements and ‘clear trading momentum to aggressively build a bigger business’.

He rates the shares as a 'buy' with a £72.50 price target and believes growth could have been stronger if stock availability was not restricted through a ramp-up at Eurohub2 and if sales were not delayed in France and Germany.