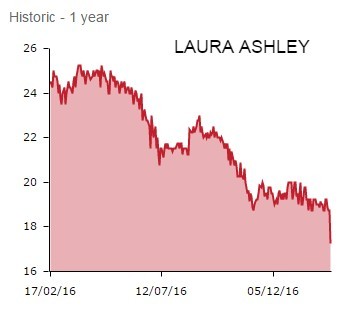

Poor half year results and a severe profit warning weigh heavily on fashion-to-homewares retailer Laura Ashley (ALY). Given prevailing headwinds and having assessed forecasts for the rest of the year to June 2017, chairman Tan Sri Dr Khoo Kay Peng warns ‘that net pre-tax profit for the year will fall below market expectations’.

One analyst has slashed pre-tax profit estimates from £17m to £11m.

The share price is down nearly 7% at 17.5p.

An interim earnings shortfall, combined with weaker sterling and cost pressures arising from the new minimum wage, are the catalysts for the profit warning, which triggers another round of earnings downgrades for Laura Ashley, proving to be a casualty of the sterling devaluation witnessed since the Brexit vote. In fact, Laura Ashley directly purchases up to $45m of its products in the dollar, which is not significantly hedged.

SOFTER SALES

Half year results from the fashion, fabric, furniture, bed linen and rugs retailer reveal taxable profits of £7.8m for the six months to December. This is not only significantly below the £9m the market was expecting, but also down from the £11m haul generated in the half to January 2016.

UK retail like-for-like sales softened by 3.5%, falls reported in the furniture, decorating and fashion categories, while investors are also digesting a half time dividend cut from 1p to 0.5p.

Sharp sterling depreciation crimped gross margins, while lower levels of promotions curtailed sales of big ticket items. July proved a soft month for Laura Ashley’s UK retail business - investors were right to fret about the impact of the referendum result on housing-related spend - and the company also says profits will be hit by the closure of concessions in Homebase, now in the clutches of Australian hardware retailer Bunnings.

‘Following these results, we are reducing our full year 2017 pre-tax profit forecast by over 30% to £11m from £17m taking EPS to 1.31p from 1.85p but expect an underlying recovery in subsequent years (FY18 £13m from £18m, FY19 £15m from £19m),’ writes Cantor Fitzgerald Europe. ‘We are also reducing our FY17 dividend forecast to 1.25p from 2p and for FY18 to 1.5p from 2p.’

CUSHIONING THE BLOW

Nevertheless, the broker is sticking with its ‘buy’ recommendation, albeit with a price target downgrade from 30p, itself reduced from 35p in August, to just 20p a share. ‘We still believe the Laura Ashley brand has significant potential for further expansion overseas and for development of the on-line channel. Institutions are however likely to wait for signs of a recovery in volumes after a likely sell off in the stock,’ Cantor comments.

Investors are clearly rattled by today’s news, but they can at least draw succour from the current trading. Revenues have recovered and the rate of like-for-like sales decline is moderating, to 0.6% in the six weeks to 11 February.