Construction outsourcing group Kier (KIE) can ill afford the kind of accounting error which the company is owning up to this morning.

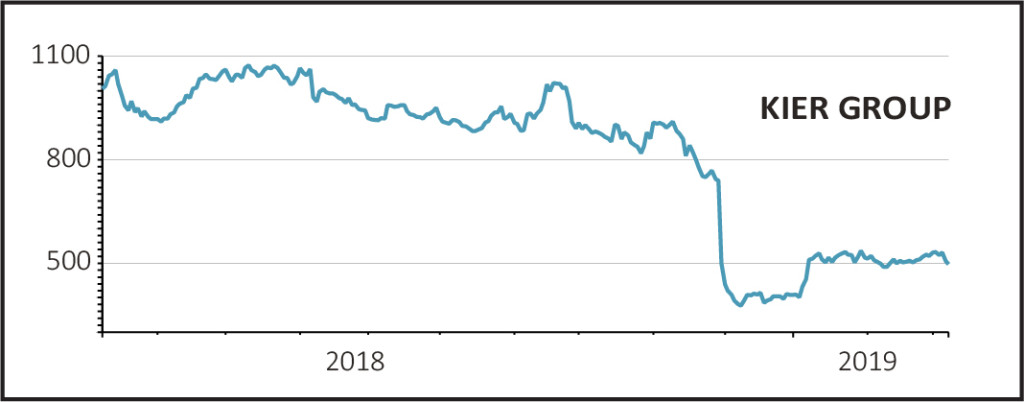

With memories of the collapse of its peer Carillion in 2018 still fresh, announcing net debt as at 31 December was materially higher than previously flagged is not likely to inspire confidence. It is therefore no surprise to see the shares dive 16.5% to 416p.

It also adds to a picture of a group which is struggling for direction following the departure of chief executive Haydn Mursell in the face of activist shareholder pressure in January.

Net debt has been restated at £180.5m, up from £130m. Adjustments relating to its hedging activities account for £10.3m of this, with the remainder attributed to a reclassification of net debt held by assets the company is in the process of selling back to underlying net debt.

Year end net debt positions are always a snapshot, typically managed by companies to show their finances in a positive light, and it is worth noting that the average month-end net debt for the six months to 31 December is also up from £370m to £430m.

READ MORE ON KIER HERE

LIMITED CREDIBILITY

Kier is still pledging it will return to a net cash position by 30 June 2019 but investors are likely to treat this with scepticism until it has been delivered.

Ultimately an unpopular and deeply discounted £264m rights issue back in December has not provided the reassurance on the balance sheet it was intended to achieve.

Separately the business has announced a £25m provision linked to delays on its redevelopment of Broadmoor hospital.

Canaccord Genuity analyst Aynsley Lammin says: 'While underlying consensus earnings may not move materially (although, we would not be surprised to see the higher end edge lower over coming weeks), clearly expectations for average net debt will move higher.

'While it is arguably not a huge impact on valuation (c.3-4% estimate on enterprise value), it is not reassuring that following the recent rights issue and update in January, a key financial item of net debt, which is under close scrutiny, is being restated ahead of the interim results.

'This combined with a further exceptional item will not be helpful for the stock's current rating or in reassuring investors that all issues relating to leverage are behind the group following the rights issue or with confidence in the numbers.'