It never rains but it pours for Mobile Streams (MOS:AIM). Years of depreciation in the Argentinian peso have taken a heavy toll on this little app store platform provider. This is important since Argentina is the company's bedrock market, so another 12% decline for the currency is squeezing sterling revenues badly, cutting pound denominated income by a third to £24.5 million at the nine-month stage.

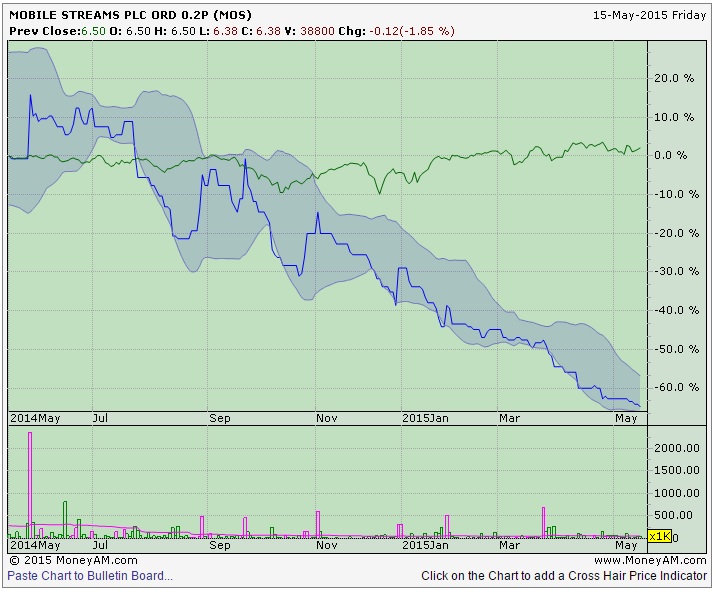

This means that Mobile Steams will miss full year income expectations by a huge margin, with revenues now anticipated at £30 million, miles off the near £37 million the market had been hoping for. In 2013 the company put up sales on £53.9 million, which puts its recent trading into context. We might have expected the shares to reverse by more than the 2% decline today, to 6.38p. That they haven't fallen further is down to earnings. EBITDA (earnings before interest, tax, depreciation and amortisation) should stay on,track at £700,000 or so, but analysts at N+1 Singer have 're-profiled' 2016 forecasts, which in plain English means lowered, with revenues now anticipated to fall to £26.5 million next year.

Compounding the company's woes is market saturation. 'Smartphone penetration is only circa 60% in Argentina, however, among these handset users the company believes the market is now saturated,' says Singer's Johnathan Barrett.

In fairness, Mobile Streams' boss, CEO Simon Buckingham, is doing the right things, moving spare cash out of Argentina when he can, and expanding into new markets - Brazil, Mexico, Nigeria and India, although we are yet to see any meaningful pay-off as yet. Still, owning almost 28% of the company, at least private investors can be reassured that he has everyone's interests in mind - he stands to loss far more than most.