Investors shouldn’t be unduly worried about online property portal Rightmove's (RMV) CEO Nick McKittrick leaving as the business remains fundamentally strong.

The well-regarded McKittrick is stepping down after 16 years and will be replaced in the hot seat by chief operating officer Peter Brooks-Johnson in May.

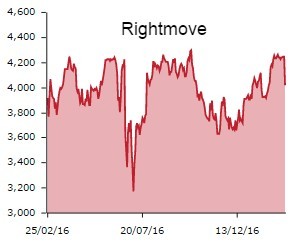

A 5% share price decline to £40.32 demonstrates investors are somewhat alarmed by change at the top, although this looks like an overreaction as Rightmove is delivering strong growth and has issued a positive outlook.

Investec Securities has put its forecasts and price target under review following better-than-expected full year numbers, with upgrades looking likely. Before today, the broker was forecasting growth in pre-tax profit to £173.7m (2016: £157.5m) in 2017 ahead of £192.6m in 2018, with Rightmove continuing to dominate advertising for the property sector.

Investec maintains its ‘buy’ rating, arguing investors should buy into Rightmove’s pricing power, high-margin model and track record on innovation. A key risk flagged is housing market softness, which would hit sentiment or the rating, although the broker stresses 'operationally Rightmove should still deliver'.

Shares recently wrote about why Rightmove is the clear market leader and whether it is a stronger proposition compared to its nearest rival Zoopla (ZPG). Management is confident of growing Rightmove's average revenue per advertiser in 2017, which is reassuring as the Brexit vote continues to loom over the property sector.

Revenue rose 5% to £220m in the year to 31 December, surpassing anticipated sales of £217.4m, while the final dividend has been hiked by nearly a fifth to 32p. Rightmove delivered an 18% rise in operating profit from £137.2m to £161.6m over the same period.